A few investing rules of thumb in a market Crash

And thoughts on likely mitigating factors of Trump's tariffs

Here are some rules of thumb that I find useful during great market turmoil:

Don’t be too plugged in on Twitter and financial news. You are probably better off reading annual reports and call transcripts. The more you fill your head with panic stories, the harder it will be to make sound investment decisions.

Narratives vs Numbers. Short term stock prices are driven by narratives, longer term prices by numbers (and facts). With some exceptions (like Tesla and Gamestop). For example the narrative in 2020 and 2021 was that fossil fuels would go away and oil stocks were doomed, but if you looked at the numbers (likely demand, break even prices, cash flows, decline rates for shale) and facts (long term contracts, hedges, bottlenecks in EV supply) they looked like bargains. Especially the royalty and pipeline companies. A lot of them already recovered before oil prices skyrocketed in 2022 as this became clear and emotions were tempered.

Don’t lazily extrapolate from the past. Many did this with real estate in 2022 (when inflation spiked). In the 70’s real estate did quite well. It didn’t do all that great this time around because we came out of a very low rate environment with already very high real estate valuations. In the late 60’s the 10 year treasury yield was 5-6% vs 1.5% in 2021. Home price ratio to household income was in the high 3’s back then vs nearly 7x in 2021! And there was no work-from-home trend to hammer office real estate.

Don’t get into too many new stocks in a market panic. First try to find bargains in stocks you’re already familiar with. When stress levels and FOMO are higher and you are just reading up on a stock, you are more likely to make mistakes. And conviction will be lower.

Quality will recover first. The shitcos and cyclicals will recover after that. Also small companies (especially manufactured goods) will be hit hardest in a high inflation scenario. Except for small companies that have a moat and dominate some niche.

Don’t buy something just because it has fallen 75%. There were plenty of software companies that traded at 40x revenue during 2021 that were still overvalued at 10x revenue in 2023.

The Holy Trifecta of value investing will go in reverse during stagflation. Let’s call it the Demonic Trifecta. Margin decline, Revenue decline and Multiple decline. Much less pronounced for quality companies.

It can be quite scary to buy as everything is falling, and you will likely not time the bottom. But remember that you are in this for the long haul. Don’t try to see it as money, see it as investment units.

If you are a value investor, don’t ignore macro completely. Remember that the E part in the P/E is partially determined by the overall economic condition. There is a reason that Buffett has written so much about inflation.

Go watch Margin Call (again).

Mitigating factors of tariffs

What I didn’t mention in my last post is that this time Europe is much less exposed. In the 70’s the oil supply shock hit the whole Western world pretty much equally. But now EU tariffed exports to the US are around $350 billion. Imports maybe $150 billion (lots of pharmaceuticals and chemicals which are exempt). This is on a GDP of $20 trillion. % looks even better if you include the UK. Compare this to the US which has tariffed imports of $3 trillion on a GDP of $30 trillion. So the EU will feel this an order of magnitude less than the US.

But within the Americas, not everyone will be hit equally either.

Mexico and Canada imports into the US that comply with the United States-Mexico-Canada Agreement (USMCA) made by Trump in 2018, will be exempt from tariffs. And % made in the US can be subtracted.

What does that mean? Well there are Regional Value Content (RVC) thresholds which are highest for autos and auto parts at 75% and 50-60% for other manufactured goods. This means that if goods where 50% of cost are made in the US, the company does not pay tariffs over the other 50% made in Mexico (or 75-25% for automotive).

This gives a hint what type of deal he is looking to make with other countries.

It could be interesting to be on the lookout for companies that are close to this threshold. Also in 2018 exemptions under a certain export amount were negotiated. Which Trump is now not honoring. These manufactured parts exemptions were rather high at $108 billion for Mexico and $34 billion for Canada. In fact they were so high that most imports were duty free. My guess is that as things get scary in the markets Trump will negotiate this number down, then sign a new agreement and sell it as a victory.

Why will he do this? Well he is a narcissist. He needs to be admired, which is hard if the economy is crashing. Remember the catch phrase “it’s the economy, stupid”? His support is already rapidly falling:

And the above graph was before the most recent market crash! If the economy and markets keep cratering pressure will be increased. No man rules alone, and he will not want to become a lame duck 3 months into his second term.

Congress can also reign him in. The problem is, he has so much political capital, Republicans can only limit his powers after it is already obvious his trade war is an economic disaster, and after it has hit main street. Otherwise they will be blamed for the fall-out. Which is also why Democrats are for the most part pretty quiet about all this.

Then there are some additional mitigating factors. Trump's trade war seems to come primarily from Trump himself. He has been obsessed with this since the 80’s. It is one of the few things he has been very consistent in and genuinely seems to care about. But it is not popular and does not really have broad support even among Republicans. This means that enforcement will likely not be that strict, especially by inspectors/states where Trump is hated. Unlike for example enforcement of illegal immigration, which does have much broader popular support (even Bernie Sanders was arguing in favor of this a few weeks ago).

This means that a lot of loopholes and grey (even illegal) areas can be more easily exploited such as:

Marking exports at a lower value

Routing exports through countries with only a 10% tariff.

Manipulating regional value content numbers (this can be sold by Trump as a victory, so he is not too incentivized to crack down on fraud here).

Reclassifying products with only minimal adjustments.

Abusing Free Trade Zones (FTZs)

Legally overwhelm CBP with lawsuits about classification of goods

Mislabelling country of origin

Straight up smuggle operations

This is further compounded by short staffing of US customs. I don’t see any signs that Trump has ramped up US Customs manpower. CBP is already short staffed to deal with the current volume. A sudden $2-3 trillion increase in imports that need to be checked will likely mean a lot of rubber stamping as they cannot keep up. Again, exacerbated by the fact that these tariffs will be deeply unpopular. Especially if there are no home grown competitors to rat out violators to customs.

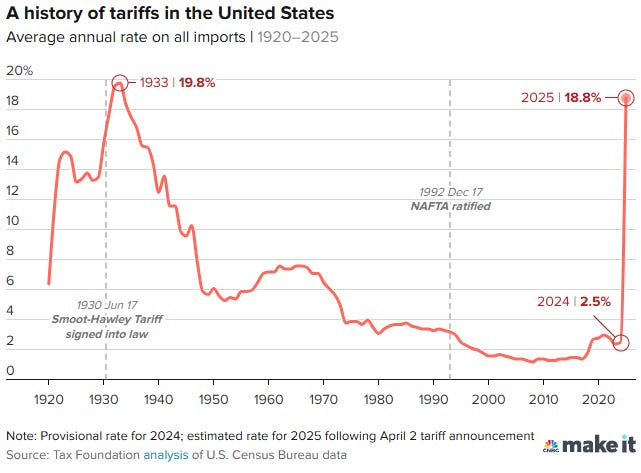

Will this cancel out completely? No, but I suspect the real tariff % paid over 2025 and 2026 will be significantly lower than the current headline number. In fact this happened during the much smaller 2018-19 tariffs. And happened recently under Biden. This WSJ article from a few months ago goes into more depth.

Finally I think this will affect factory prices for the rest of the world. Meaning for EU companies that import from China or Vietnam, they will likely get better prices in the coming year or two improving margins for EU companies that sell foreign made goods. Overall value affected by EU + UK is about $380 billion of exports vs a $23 trillion economy.

To sum it up, what I think will happen in the coming week/months:

Scary headlines in the coming week, as more people wake up to this, with more panic selling especially in US stocks (unless Trump blinks, which is unlikely). The EU will probably retaliate too in limited capacity.

The supply shock will be much more limited globally ex-US compared to the oil shortage of the 70’s, and valuations of ex-US stocks are far lower.

Exemptions announced which are lower than previous agreements under USMCA, which will be sold as a victory by Trump. This is likely to happen both because CBP cannot keep up, and because of immense lobbying pressure on Trump.

I don’t think world wide tariffs will completely go away during Trumps term unless things get really bad. He really wants to create more home grown industries.

Then reality sinks in, impact to economy in medium term lower than expected (with exemptions and fact that US customs will do a lot of rubber stamping)

Followed by a partial recovery, but the economy won’t be as good as the past 4 years.

A lot of US companies are still overearning coming out of Covid, they will be hit quite hard.

One or two really ugly quarters for more cyclical manufacturing companies.

Possibility of some sort of stimulus check, framed as a payback of those tariffs to regular working people (kind of like Trump's Covid stimulus).

Finally I changed my mind on airlines, I would just stay away from most US stocks, with some exceptions.

Happy investing everybody and remember that cool heads always prevail.

Great article. What tickers would u still be buying in usa

Thanks so much for putting in the effort to provide such thoughtful context again. This latest edition was once more a great read – clear, insightful, and genuinely valuable. Much appreciated!