Almost Longs #2

UMDK and Chinese textile stocks

This is part Two of my Almost Longs series. I promised to write an article on United Mobility UMDK at the end of my last post. But while I was writing it some things happened causing the stock price to crash almost 50% kind of confirming my suspicions.

UMDK has several mentions by investors that I respect. The most thorough write up here is by Toff cap (check out his substack, it is quite good). It looks like a really cheap stock, but I cannot make heads or tails out of their financial reports. Supposedly they made nice profits in the past couple of years, and if those profits are real the stock is really really cheap. But free cash flow was actually negative. It seems all their profits are paper profits that went into “other assets”. Not in the investing section of their cash flow statement, but through a change in other operating assets above the cash from operations line, which is a bit fishy.

UMDK also doesn’t break out any of their segments, which is strange. In the write-up above this was chalked up to bad shareholder communication and so basically bad management. But I don’t really buy that the CEO is so incompetent/busy that he cannot figure out that breaking out segments is a good idea. This should also not be all that time consuming to do. I bet they have this data internally.

Then their financials are confusing, why are there 3 columns, one without a year:

This is probably me being a dumbass though.

Although I am not alone in my scepticism. On this discussion forum some users have also questioned the financials (google translation of a post by user Mathi9580):

The "why" can be explained very well, if you want to hear the explanations. Lack of trust in the management, complete lack of transparency in the annual financial statements with regard to the most important balance sheet item and the question of why the HGB was partially ignored when preparing the annual financial statements. There are many indications that the picture UMT is trying to draw is a completely different picture than the actual picture. And it is precisely these points that are recognized and evaluated by the market and that is why the price is probably still too high where it is.

If this was a Hong Kong stock I would not touch it with a ten foot pole. And would have moved on already. But this is Germany so I was still tempted to buy a small tracker position purely because it is so cheap, but then yesterday the company released some pretty bad news. The kind that you really really do not want to see as a shareholder. It contained:

Announcement of a major share offering which of course makes zero sense at these valuations and is a huge red flag

The recently appointed CFO resigned

Major impairments will be made to their recently acquired construction business and their software business. While in the same breath announcing intent of new acquisitions.

Delay in release of 2022 annual report

The only thing missing now is news of the CEO fleeing to Venezuela to make this a perfect bowl of diarrhea.

It appears the majority of their earnings will probably come from the asset management business going forward? They are pretty vague about what this business does exactly. And it is hard to see how anyone would trust these guys with €400 million when they are messing up the basics so hard and are issuing shares at a rock bottom valuation, when they should have enough cash on hand, in theory at least?

That said, most of the shares outstanding are owned by the previous CEO, 2.9 million of which were issued at €8 in 2020. And if earnings are even remotely real, the stock is now insanely cheap. So I will keep an eye on this one, but there is too much stink surrounding it for me to own it after recent announcements.

Since this was pretty short I thought I would tack on Texhong as well. They are a upstream textile producer slowly moving into more value added products. This is a stock I have owned in the past and is liked by several blogs I follow as well. And has a whopping 3 VIC write-ups. Usually when cotton prices spike up, their margins greatly expand, but as they crash, margins collapse. So this stock can appear cheap at times, but beware, it will cancel out.

As cotton prices have collapsed recently from a large spike upwards, the company is currently not doing very well. Even the 900 pound textile gorilla Shenzhou, which is normally pretty immune from cotton price swings, is far from its highs and has seen serious margin contraction.

The problem with Texhong is that ROIC has always been average, hovering around 10%. If they return to 2019 margins, the stock trades at about 4-5x earnings, or about 11x EV/earnings with a <10% ROIC. This is on the cheap side, but Texhong has rarely traded above 7-8x earnings in the past. And they still have major operations in China which will become increasingly problematic as cheap labour is running out there.

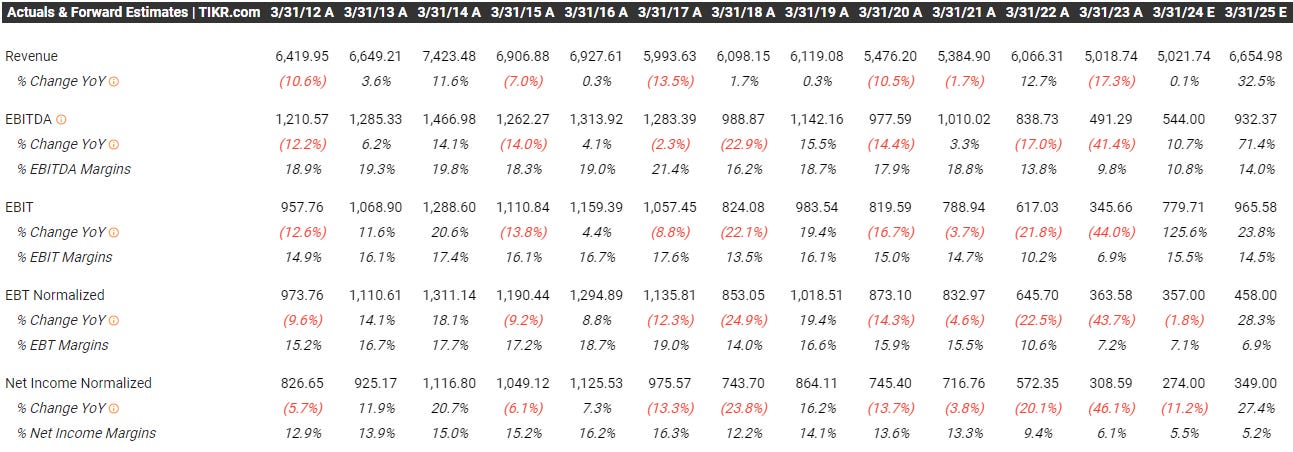

What worries me most though is that even higher quality textile companies like Shenzhou and Pacific Textiles are forecast to have significantly lower margins in the foreseeable future:

Now if a beast like Shenzhou has problems, a weaker upstream player like Texhong will feel it even harder. And they do have quite a bit of debt. Which is the reason I am staying away.

I actually did briefly own Pacific Textiles this year, but luckily quickly sold it again. They seem to be in between Shenzhou and Texhong in terms of quality. The stock has crashed after recent disappointing results, and because of their lack of debt and high ROIC they have historically paid out nearly 100% of earnings in dividends and some buybacks. If Pacific were to return to 2019 conditions it would trade at about 3x earnings and a 30% dividend yield.

If their buybacks continue beyond a few million HK$, I think I will consider a small position in Pacific Textiles again. Crystal International is another more downstream textile stock to keep an eye on as well. As it only trades at 5x earnings, and seems to have held up reasonably well in 2022.

That will be all for today, none of this should be taken too seriously, and do your own due dilligence before buying or selling anything. I have no position in the above mentioned stocks.

Hello!

Thanks for giving your thoughts on UMDK.

"The only thing missing now is news of the CEO fleeing to Venezuela to make this a perfect bowl of diarrhea." :-D

Actually yesterday I put a warning in front of my article: https://simonbrenncke.substack.com/p/united-mobility-technology-when-you

[WARNING: Trouble may be brewing in paradise. The first of June 2023, Alexander Hupe was appointed to the Management Board in the role of CFO. Just one month later it was announced that he resigned from the position. What did he do in the meantime? "Mr. Hupe has been actively involved in the preparation of the annual financial statements." Didn't he like what he saw? I have no idea. However that may be, one day after making the resignation public, on the fifth of July 2023, UMT announced they were writing down the value of their assets Buchberger and Mobile Payment UMS. As to Buchberger, it was to be expected ("due to the stagnation in the construction industry"), but Management adds in the announcement: "...and the legal case." From a former announcement, I thought the legal case all but resolved; however, even unresolved I believe it's not consequential. Consequential, however, is their perception of UMS, their biggest asset, the rationale of the reduction in value being: "the successes from the payment business have not yet been seen". Two short announcements with little information that apparently scared investors a lot, driving down the stock price - this and the prospect of a capital increase "to secure liquidity" and for further acquisitions, when according to the H1 2022 financial statements no liquidity would need to be secured, as the company was flush in cash and cash equivalents on paper. It fits with the unlucky communication style I flagged below in the article. Add to this inconsistent communication; Management promised the numbers for full year 2022 until the 30th of June (cf. Financial Calendar on their website) and did not deliver on that promise. Perhaps I'll write another update article when full year results 2022 come out, still expected for July 2023.]

As you can see, I still do not think that fraud is involved. But I'm a dangerously naive person, so that's that.

"It seems all their profits are paper profits that went into “other assets”. Not in the investing section of their cash flow statement, but through a change in other operating assets above the cash from operations line, which is a bit fishy."

Could you elaborate further on that? I would appreciate a lot if you could break it down granually, so I can follow better.

that's what I was thinking too, but I'm guessing it's not the case with the reporting standard they're using. I suspect ToffCap is German, and thus he knows what he's talking about. Anyway, there is just so much stuff about UMDK that is weird and opaque that I moved on rather than trying to definitively answer this question.