Another insider trade

Lufax again this time

I think it is time to get back into Lufax (LU) again. First time I wrote it up on my blog I spotted an insider trade on the HK exchange that somehow the US exchange did not pick up on. A very large volume spike the day before earnings (they did announce a large special dividend the next day).

There are currently no large volume spikes on the HK exchange. Unfortunately the auditor (PWC) resigned early this year about a related party transactions dispute. Which is most likely with Ping An which owns ~75% of Lufax Shares. So the company has delayed filing its annual report and the stock has stopped trading on the HK exchange.

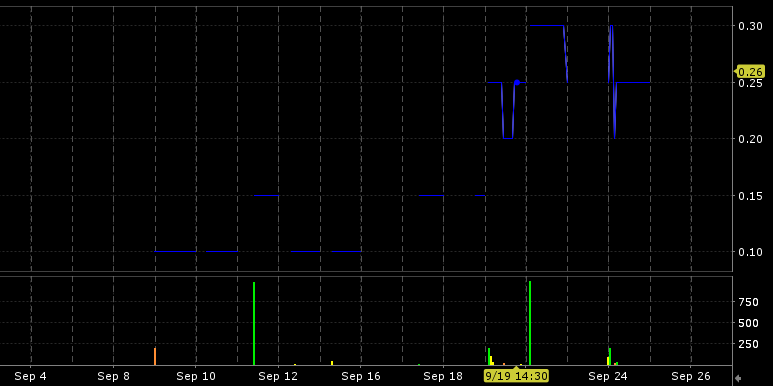

What piqued my interest though were some recent unusual trading patterns on the US options exchange, someone seems to be backing up the truck on options (which are normally quite illiquid as Lufax is a $2-3bn Chinese stock with a small float).

Oct 17 2025 $4 call options:

Nov 21 $4 calls:

Dec 19 $3 calls:

Dec 19 $4 calls:

Mar 20 2026 $2 calls:

So that is several $100k in option trades over a fairly short amount of time. Maybe somebody knows something? Maybe Ping An will buy out the remaining 25% they don’t own? Lufax trades only at about 22% of tangible book value. If Ping An offers 40% that is nearly a double from here. Those $4 options would be well in the money. Ping An has a fairly strong incentive to do this. They did something similar recently with OneConnect (Ping An owned 65% before taking it private at a fairly sizable premium).

Even if this is not some insider backing up the truck on insider info like last time, there are reasons to be bullish:

Lufax has called an extraordinary general meeting on September 30. One of the things on the agenda is increasing its annual caps relating to Ping An consumer financing business. This seems bullish for demand.

The Chinese government has set up an interest subsidy on consumer loans.

CCP gives support to consumer loan companies like Lufax (cheaper financing)

CCP has introduced a lot of new regulations in the past 1.5 years which will benefit Lufax and hurt its smaller competitors.

As I have mentioned before, Lufax has switched to a new model where they basically take 100% of potential loan losses up front in a fairly conservative way. This has artificially depressed margins and should no longer be a headwind going into 2026. Earnings could surpass $500 million in 2026. TIKR analyst estimates sit at around $450m for 2026.

Lufax still has about $1.5-2.35 in net cash/share on their balance sheet (depending on how you count). Vs $3.55 share price right now.

Given all this, I am back in Lufax with a fairly sizable position. I see this more as a trade than a long term investment though. Downside should be fairly limited here, while upside could be substantial.

Disclaimer: Readers of this blog should do their own due diligence before buying or selling any of the mentioned stocks, since I have been wrong before and cannot guarantee all information in this write-up is 100% factual. I may buy or sell the above mentioned stocks at any time. Past success is no guarantee for future success. Some of the stocks mentioned might have poor liquidity, so make sure to check average daily trading volume before buying or selling anything. I am not your financial advisor.

any updated thoughts after the shareholders meeting a couple of days ago?