Berry Global

Plastic packaging at a 7x PE

Trades at ~7x FW earnings

Organic growth of 1-2% year

Able to pass on raw material cost increases

Almost identical Australian listed competitor trades at 15x FW earnings

Very stable recession proof demand for their end products

Berry Global (BERY) sells primarily plastic consumer packaging (>70% of revenue). Health & hygiene and engineered materials is the other 30%. Almost all of their products are likely to be in growth markets. So this is not a melting ice cube. Their presentation has a nice overview of their product lines.

The company seems to be able to easily pass on raw material costs and generate stable EBITDA throughout some pretty wild swings in oil prices. And generates very stable above average returns on tangible capital of about 15%.

What makes this situation interesting is that a lot of long only funds cannot own BERY if debt/EBITDA is > 4x for regulatory reasons. Current debt/ebitda is about 4.3x. Due to stable demand for their end products and earnings, leverage can be higher compared to most other types of businesses. Historically, debt stayed high due to consolidation, but the company has run out of large acquisition candidates. So we are now in cash harvest mode.

With $9.3bn of net debt and FCF generation of about $3bn in the next 3 years, debt/EBITDA will soon be in the 3.x range. Say that company will buy back 15m shares for $1bn, and pay down $2bn more debt. Then by the end of 2024 with expected EBITDA and FCF of $2.4bn and $1.1bn respectively, the stock would be trading at only 5.5x FCF.

Company currently has $700m remaining on their buyback program, with $350m of buybacks expected before October this year.

Amcor, an almost identical Australian listed competitor with similar growth rates, but lower debt/EBITDA of 2.75x is trading for 15x earnings. So I think the main sticking point for the market is high debt and lack of a dividend (Amcor pays out ~⅔ of FCF in dividends). Even though it would take less than 3 years for BERY to get within the same leverage range as Amcor.

Interestingly the discount between these two stocks was not always as large:

I don't really know what caused the sudden gap. A possible reason is that BERY closed down some low return product lines after their large acquisitions. Which made it temporarily seem like organic growth was negative. Or maybe the rate increases in 2018 spooked people.

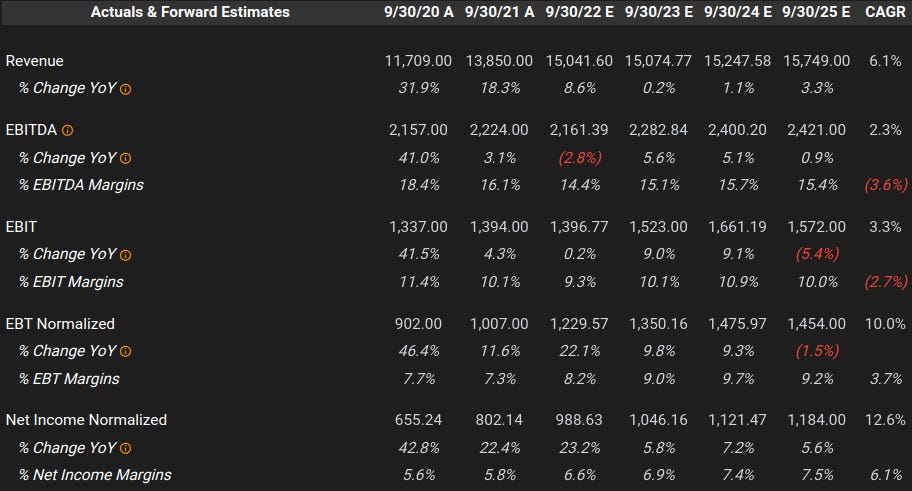

This is the past 2 years and estimates for the next 4 years for BERY:

And for Amcor:

Very similar margins, EBITDA size and expected growth rates right?

BERY management has reiterated adjusted EPS guidance of $7.2-7.7 for 2022. So it does not seem like they were affected all that much (besides some one time working capital movements) by the large spikes in oil prices.

As for interest rate risk, about $5.2bn of debt is due after 2024 and has low fixed interest rates. They do have a $3.4bn term loan, due 2026, with floating interest rates. But they also have sizable interest rate hedges. So I don’t really think that is going to be an issue, or the reason for current cheapness.

So I think this is a nice stock to own in the current volatile environment. Very stable demand, proven ability to pass on raw material cost increase, several catalysts, an almost identical competitor trading at a large premium and a nearly 15% FCF yield. Basically a bet on mean reversion with about 100-150% of expected upside. It does require some patience though.

Long at a price of about $55 per share. Goes without saying that you should do your own DD and I may sell at any time.

Groupe Guillin SA is another pretty good comp - 'cheaper' than both the above.

Are they already effectively below 4x levered? As of the last fiscal year-end, they claimed to be at 3.8x. See slide 7: https://ir.berryglobal.com/static-files/efe6c178-871e-4f28-919f-a790c5e32a35

That's consistent with the following year-end numbers in the 10-K:

EBITDA: $2.2 billion

Cash: $1.1 billion

Debt: $9.5 billion

Net debt: $8.4 billion

8.4/2.2 = 3.8

They've crept above 4x as of the last quarter end due to working capital movements causing net debt to increase, but if their projections for the next two quarters are anything close to correct, they'll be back below 4x by then. Management confirmed this calculation on the last call:

[Analyst]

Just one on my end on the capital deployment side of things. I think as of quarter end, you're maybe a little bit above 4x levered. So I guess, A, where would you expect net leverage to be by year-end? And does that kind of impact your way at all in your pace of buybacks? Obviously, you picked it up a bit near term, but just how should we think about that balance between net leverage and buybacks this year?

Thomas Salmon

We continue to believe after the full year, we'll be able to operate the company within our targeted range [i.e., 3 - 3.9x] , and it's reinforced by the fact that the majority of our cash flow generation typically occurs in the fourth quarter -- third and fourth quarter, sorry.

***

Part of the confusion may arise from the fact that same data sources do not appear to match the SEC filings. For example, I could not reconcile Tikr's numbers with what's in the 10-K.