Cleveland-Cliffs

Another heads you do ok, and tails you win big stock

Trading at 10-12x FCF, debt free and ~10% ROIC at 2019 steel prices

2019 steel prices were reflective of past decade average

Likely trading at 20-25% FCF yield going forward

Company will have low cost advantage

Everything set up perfectly for higher steel prices in medium term

Well this is the last write-up I will do for a while.

Cleveland-Cliffs (CLF) used to be a low cost iron ore mining and pelletizing company and is now a low cost steel company that sources its own iron ore pellets at a low cost of $65-70 per short ton. It has done this by making two large acquisitions recently, AK Steel (AK) and ArcelorMittal USA (AM) at December 2019 and September 2020 respectively. And due to skyrocketing steel prices this year and at least early next year will be debt free somewhere in 2022.

I think steel prices could stay materially higher, but let’s first look at the base case where prices return to past decade averages.

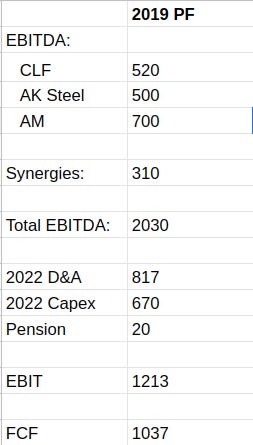

A rationale for my pro-forma 2019 estimate at $600 HRC steel prices:

Sources are announcement AK merger and AM merger. According to CLF Q1 2021 call, sustaining capex is about $525m and total synergies $310m. According to Q2 2021 call pension costs going forward are about $20m. The $670m capex number is an estimate for this year and next year. And it seems like synergies are mostly in the pocket already. I added up CLF’s EBITDA from selling their iron ore pellets since that is a cost AK and AM will no longer have to pay.

Steel prices have averaged almost exactly $600 in the past decade, not counting current sky high steel prices in 2021 (source).

Current market cap is about $11.6b. So that is a ~9-10% FCF yield depending on where capex is going to be. Slightly cheaper than the 9-15x EV/EBIT AK has traded at in the past decade. Since CLF has most of its revenue already fixed for this year at steel prices at ~$1k per ton, 2021 YE debt will be around $2.3b and 2021 and 2022 FCF will be expected to be a combined $5.6b. So debt free somewhere in 2022.

As for ROIC at $600 steel, it is hard to estimate because inventory and receivables are inflated by the higher prices. If I had to guess, I would say ROIC would be between 8-12% in this scenario.

A steel Lollapalooza?

I think the steel market is perfectly set up for higher prices in the coming years. On the demand side, multi trillion $ infrastructre plans that have been announced will require a lot of steel. And auto dealer inventories in the US are at all time lows.

On the supply side, Chinese steel production is a major polluter and responsible for 15% of Chinese CO2 output. And more than twice as much per ton produced than the US. And the government has announced it aims to curb production. And seems quite serious about it. Reasons are probably that steel is esesntially a low value add dirty industry that is heavily dependent on Australian iron ore imports, a country China is constantly in conflict with. As China is moving towards higher value-add industries and wants to look good for the world (especially in the 2022 olympics) it would make sense why they would at least no longer be a net exporter of steel. Especially since a lot of these steel companies depend on government support.

Then on the cost side, over 70% of US steel production comes from EAF mills. These mills are environmentally friendly, but require high quality scrap steel as input. And it looks like a prime scrap steel shortage is on the horizon, the CLF CEO sums it up nicely in the Q1 2021 call:

This leads me to my final factor, the one that will drive mid-cycle, hot-rolled coil pricing higher for the long term, the scarcity of prime scrap. EAFs make up more than 70% of steel production in our country. This U.S. reality is unique among all major steel making countries. EAFs have long taking advantage of the large pool of scrap here in our country. However, with all the new capacity coming from the EAF side of the business, their scrap feedstock has become stretched, although thin. In order to make flat-rolled products in EAFs, you need prime scrap and metallics, both of which actually originate from the integrated rock. On top of that, manufacturers have become more efficient at processing high-grade steel, generating less prime scrap to be sold back to the system.

The United States is a net exporter of scrap, but it is also a net importer of prime scrap. Combine that with China's growing needs for imported scrap, which will outpace their own generation in the near term, and the U.S. EAFs have a big problem. Obsolete and lower grades of scrap will likely be okay, as higher prices incentivize collection. But that's not the case for prime scrap. Lower grade scrap is good for rebar, but it's not good or not enough for the production of more sophisticated flat-roll steel products. This scarcity points to significantly higher prices for scrap.

Finally as a result of all this, the steel industry has been consolidating, which generally makes it easier to control capacity in case of over capacity.

So what do they earn in a $1k HRC/mt scenario? Well due to legacy contracts at lower prices I think they are already there in H1 2021. Even though spot market is trading higher. Looking at volumes and revenue in their 10-Q, it looks like they generated about $1.2bn EBIT in H1 at prices hovering around $1k per ton. A significant portion of steel is sold below spot prices according to Q2 2021 call:

While all of our relevant Q2 figures represent company records: revenue, net income, adjusted EBITDA, I would add, we haven't reached our full potential yet. Due to previously agreed upon sales contracts, so far this year, we have sold a significant chunk of our volume well below price levels that would make us comfortable. Our most important commercial priority through the end of this year will be to improve these contracts.

This implies that if HRC steel prices stay at $1200-1300 next year, and contracts roll off, FCF could be in the $4-6bn range in 2022! At highs this year of nearly $2k, the company would trade at <1x FCF if that was sustained for a full year.

Whereas if they stay in the $900-1k range, FCF would be close to $2bn. So earnings yield is in the 9-50% range. Which I think is too cheap. Stock is probably still cheap because the acquisitions have made it hard to ascertain CLF’s true earning power in a low steel price environment and due to the big run up in the share price already.

So I am long at an average price of about $23 per share. I may sell at any time though, so DYOW.