Closing some idea's

And adding 4 more

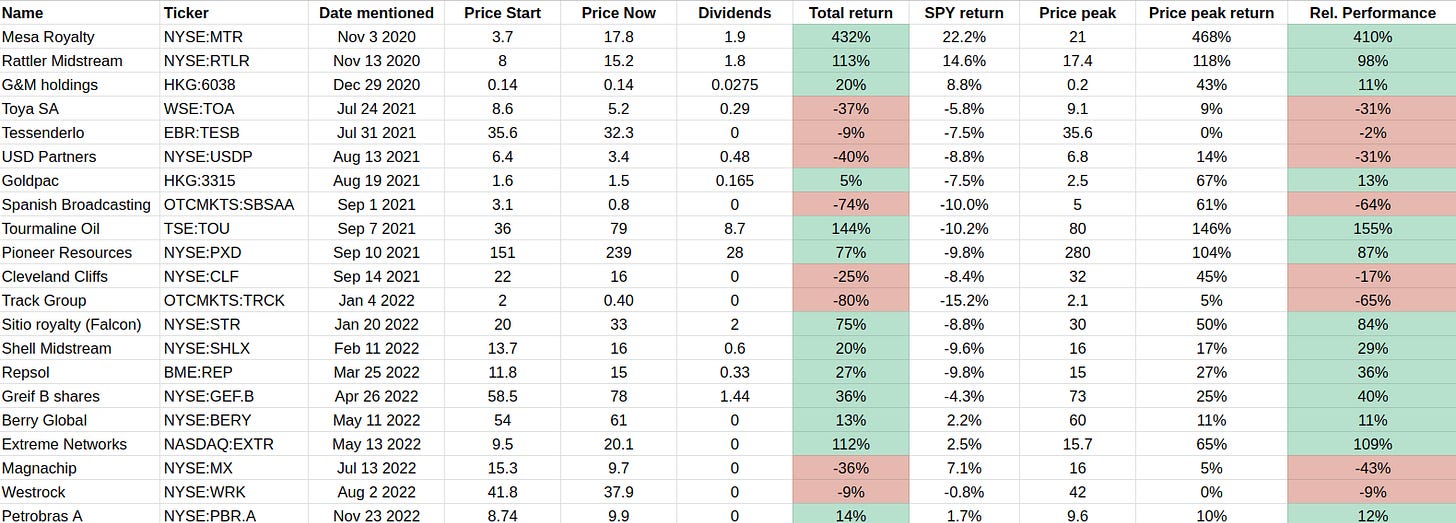

In this post I tracked my performance on stock mentioned in my blog, and I would like to officially close some ideas here. I will start doing that from now on. Something I did privately but not on the blog publicly. Either because they have worked out and upside is no more attractive, or because the facts have changed.

I am also adding 4 new names as of now. The first one is Goldlion holdings (HKG:0533), there was some discussion in the comments of my last post. I had lazily skipped this one because of the inventory built up, which is always a large red flag. But on closer inspection it was actually real estate that was developed and is held for sale. Would be nice if TIKR actually separated those two.

So it kind of seems like a no-brainer with its history of large dividend payments and the large net cash balance and China likely opening up again the coming year.

Last 3 are merger arb situations with double digit upside. Tegna, 111 and O2Micro. All three are discussed in this Seeking Alpha article recently. Especially Tegna seems fairly interesting as the downside seems very limited. And it is pretty likely to close within 6 months.

This is the current list with a full write-up:

And mere first mentions:

Of the above 2 lists am closing the following ideas:

Most of these have worked out fairly well. But some like Tessenderlo or USD Partners have seen worsening fundamentals. USD Partners I may open again at some point, but it depends on what happens to the SPR release the coming year. It seems this has really lowered demand for heavy oil at coastal refineries, delaying their long term DRU contracts. I think downsize risk here has increased significantly. But also serious upside potentially remains.

If they do sell all their capacity on 10 year contracts, the stock could go to $10. As it would only trade for about 2x FCF. But at this point I am not so sure if SPR is even entirely to blame, and I have a hard time handicapping that. So on the sidelines for now as debt is now sizable since the recent acquisition of a new terminal. But keeping a close eye on it.

As for Cleveland Cliffs it seems the worst case scenario is kind of playing out and there are a lot more interesting ideas you can park your money in. FCF will hover around $1bn in the coming years. So not all that attractive. It did make for a nice trade if you were smart enough to sell at $30.

Greif has also worked out nicely. But I think from here on out the upside is limited. It isn’t really a compounder and they have mentioned acquisitions again. They do have a fair amount of debt and they probably over earned a bit this year. It was a nice trading idea though.

Same with Westrock which has not worked out as nicely, as 2023 will be a bit worse than 2022. So not really the bargain I thought it was.

Berry global will probably have a somewhat disappointing 2023, so I take the opportunity to close it here.

Extreme Networks I am kind of on the fence, as it could surprise on the upside. But it trades at 14x 2024 earnings. And is much more expensive than the stocks I usually hold. If rates go down to 0% again, this stock probably has further upside, otherwise I think it is probably close to fairly valued here?

Orion and Vontier I also changed my mind on. Especially as they have creeped up somewhat in price. And my outlook has actually worsened a bit. And they are too cyclical for my taste.

Kaspi looks cheapish at a 10x FW PE, but it is still Kazakhstan, a country that has seen their currency implode 70% in the past decade. You need a 13% earnings CAGR in local currency to break even to counteract that. And it kind of feels like they are over earning with those 70%+ EBIT margins? It was always more of a nice trading stock for me anyway whenever it traded down to $40-50 and the dividend seemed more secure. Which was actually disappointing this year, and that is always a bit of a red flag with stocks in developing countries.

Never really got the FinTwit hype around this stock. I don’t think it deserves to trade at a 20-30x PE.

Stocks that are now pretty tiny speculative positions and wouldn’t buy anymore of, are: Spanish Broadcasting and Track group. I no longer hold Magnachip, but can’t bring myself to close these. So this virtual portfolio is not the same as my actual one. It has fewer holdings than the current open idea list.

It will be interesting to see how many of the closed ideas end up outperforming.

As always do your own research and I may sell and buy any of the stocks mentioned here at any time.

Found another interesting HK stock - Sundart Holdings /1568.HK/. They are one of the leading fitting-out companies in China, Hong Kong and Macau and work with large office, hotel and residential complex clients. Market cap is HKD 650m, net cash/investments is HKD 1.4bn (yes, 200%+ of MC, it was 300%+ as of YE21, but they settled some trade payables) and avg. profits since 2015 are ~HKD 400m/year. At 10x PE + net cash this should be 700% higher and up until 2020 it was trading 1200% higher. They have suffered this year due to the construction meltdown, but are still very profitable. My main concerns here are the increasing amount of overdue receivables and the relatively low cumulative payout of 34% since 2017 (hence the huge cash pile-up). Still, at such a huge discount and a 23% trailing div. yield (at 40% payout), I couldn't resist. Unless the numbers are completely cooked I don't see how one would not make a very decent return here in any scenario. Do you have any method of searching for financial shenanigans/red flags on Chinese companies? I checked webb-site.com from your HK article earlier this year, but didn't find it particularly useful. Curious to hear your thoughts.

Cheers IJW - some great posts. Need you back on Twitter, I was searching for China opening ideas that weekend and literally have no one to bounce ideas off.