Europe will be fine

Short term will hurt though

Lately I have seen a lot of doomporn on Twitter about Europe. A lot of people seem to almost be excited about the energy predicament Europe is in. So I thought I would write some anti-doom porn. And in doing so I actually became a bit more pessimistic LOL. At least for the next year or two.

Since there is no denying that the EU is in a bad spot as it imported 150 billion m3 of gas from Russia. Out of 397 billion m3 consumption. So 38% of consumption. But overall consumption is already down 15% over the past decade. And now Putin has cut supply to about 30 billion m3. So a 120 billion m3 hole.

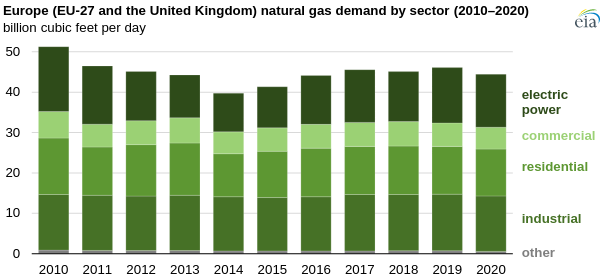

This is a breakdown of demand, about 40% is used for heating by residential or commercial (source):

And about 25% is electric power, which can be partially replaced by oil and coal in the short term (and renewables and nuclear in the longer term). As gas plants can also burn oil. Industrial is probably harder to replace.

I can bring down personal gas usage between 30-50% with relatively modest investments. The payback period has gone from 10-15 years to 1-2 years for a lot of these measures. So there is probably quite a bit of stretch in residential and commercial demand. Although I am probably a bit of an outlier as I live in an older home.

Also everyone just turning down the thermostat from 20 to 17 degrees (68 to 63 degrees for the Americans) would take an 18% bite out of Russian imports alone.

Then there is the Dutch Groningen gas field, which produced 50 billion m3 of gas per year in 2012:

This accounted for ⅓ of all current Russian imports to the EU. In 2022 this field will only produce 4.5 billion m3! At current gas prices, every household in the earthquake risk area can be given 300-500k euros from one year worth of profit if production is returned to 2013 levels.

I have been thinking about this, and why won’t the Dutch government set up a tax free royalty trust? Where every household gets 50% of the profits? You cut out the middleman and solve the trust issue people in Groningen have with the government. They get 5-6 figures/year, and if they don’t like it, they can simply sell their house? If your property has a fat royalty attached to it, I am sure they can sell their home at a large profit if they want to. Or they keep it, and buy a new house somewhere else, living from their royalty income.

Or they can earthquake proof their home, that costs about $5-10k from doing a few cursory Google searches. Additionally, fracking tech has advanced quite a bit in 10 years. There are now ways to greatly reduce earthquakes.

Continuing on, another 20-30 billion m3 can be replaced with LNG imports in the short term. And there will be more global LNG capacity additions over the next 3-4 years than Russian exports to the EU.

So in the short to medium term, the main obstacle against a solution for the energy shortage is mostly political. As household heating bills shoot up past 5-10k euros per year, I don’t think the greens will stand much of a chance. There will be three choices:

Let EU industry die and saddle its population with 5-10k+ euro annual energy bills

Give Putin what he wants and give him at least a portion of the Ukraine, and potentially portions of the EU when he is done with Ukraine

Open up those EU gas fields, temporarily increase coal and oil for electricity and build more nuclear

Really, how is this even a choice? I'm sure there are a lot of Humphrey Appleby’s working behind the scenes right now to let this fully sink into the heads of their ignorant politicians. And as those energy bills start coming, it will sink into the heads of voters too.

Russia is hurting too

Let’s not forget that Russia is also hurting. But this hurt will only gradually become more and more apparent over the next 5 years. Exports from China to Russia have fallen by 40%, vs 60% from EU and US. Since Chinese companies get way more revenue from the West they don’t want to risk those trade relations by ramping up exports to Russia. So Russia’s industries are slowly deteriorating as they are starved of crucial higher tech parts. But for now they will hold on. Companies can postpone capex for quite a while.

And financially Russia is burning through its forex reserves, and despite its high exports and its lack of imports, is expected to run out in about 2-4 years (see this paper for more info)

Burning up all that gas is probably costing Gazprom as well. There are probably at least $25-35 billion of operating costs associated with EU gas production. Personnel are either paid or potentially lost forever.

So Europe’s problem is that it is hurting RIGHT NOW. And in 3-6 years, it will not really need Russian imports and will be fine. Russia is doing ok right now, but will be greatly hurting in the medium to long term.

So this is a situation where Russia is a poisoned man that is desperately punching Europe in the gut to get its antidote. While those gut punches hurt right now, in a few years they won’t and then the West will basically have Putin on a leash.

Why else would Putin sacrifice a steady $50 billion/year revenue stream? On a $1.6 trillion Economy. And its main geopolitical tool to exert pressure on the EU? I think it is a sign of desperation, not of strength.

Meanwhile he has had to sacrifice a lot of Russian lives since April to basically make no progress in taking Ukrainian territory (source):

While Ukraine gets increasingly more advanced weapons, and Russia is now increasingly using older equipment. And is dealing with manpower shortages. We are only 6 months in and Russia is already emptying prisons for soldiers.

So I will happily sit in a cold living room for a couple of winters, with an extra layer of thermo underwear, so that the West can have Putin on a leash by 2025.

What this means for stocks

I saved this for last, for the people who slogged all the way through. There are several industries which will see likely European shutdowns, unless Putin turns the gas back on of course. They are chemicals, paper(board) and metals (steel and aluminum mostly). A study was done on this recently. So then the question is, what will happen to their profits? If there is a forced shutdown of 20% of capacity that means shortages. Which means pricing power. Even though costs are high, profits might be far higher?

I would love to hear feedback on this. Meanwhile here is a list of stocks that might benefit (or hurt):

Synthomer, a UK specialty chemical producer. Historically it has generated above average returns. It does have some debt though.

Orion Engineered, they have capacity in Europe. And could export to Europe. Mix between specialty and commodity. They say they can replace gaspower with oil generators, and gas shortages won’t be an issue for them. Write-up here.

Trinseo, a mix of commodity and specialty chemicals. They were going to sell their styrenics business, but have put that on hold for now. About 60% of revenue comes from Europe.

Celanese, specialty chemical producer with a very strong market position, but quite a lot of leverage. Buffett owns this one. Write-up here.

Smurfit, Westrock, Greif, Three mostly paper based packaging companies. I have written up the last 2 on this blog here and here.

Arcelormittal, Steel producer with a lot of exposure to Europe. 2.8-4x FW PE and no net debt by year end.

Out of the above I currently own Orion, Westrock and Greif. I sold Celanese recently. Thoughts welcome.

As usual, do your own work and I may sell at any time.

Articles like these are of supreme importance in times like these.

Thank you!

Thanks for writing this. I agree with you that europe will be alright. Doomsday articles unfortunately sells well. I find it very 1 sided and underestimating human’s ability to overcome all odds.