Falcon Minerals

High quality royalty trust at a 30% discount

FCF yield between 12-18% at $70-100 oil.

Debt at <1x EBITDA after merger

Larger and growing asset base will drive rerating

Reason for cheapness is likely lower dividend

Falcon Minerals (FLMN) is a royalty trust whos primary asset was the Karnes trough in the Eagle Ford shale. This is one of the lowest breakeven oil reservoirs in the US with a 10+ year drilling inventory with high quality large operators. And for about a year now it seems to have mostly traded at a discount to other royalty trusts. Probably because it has a much smaller asset base, and management with a spotty track record.

Most other trusts have already recovered to their 2019 highs, but FLMN is still about 40% below.

The reason I compared FLMN here with VNOM and DMLP is because they are both Permian royalty trusts. The Permian is one of the lowest breakeven oil and gas fields in the US with full cycle breakeven costs between $25-35 per barrel.

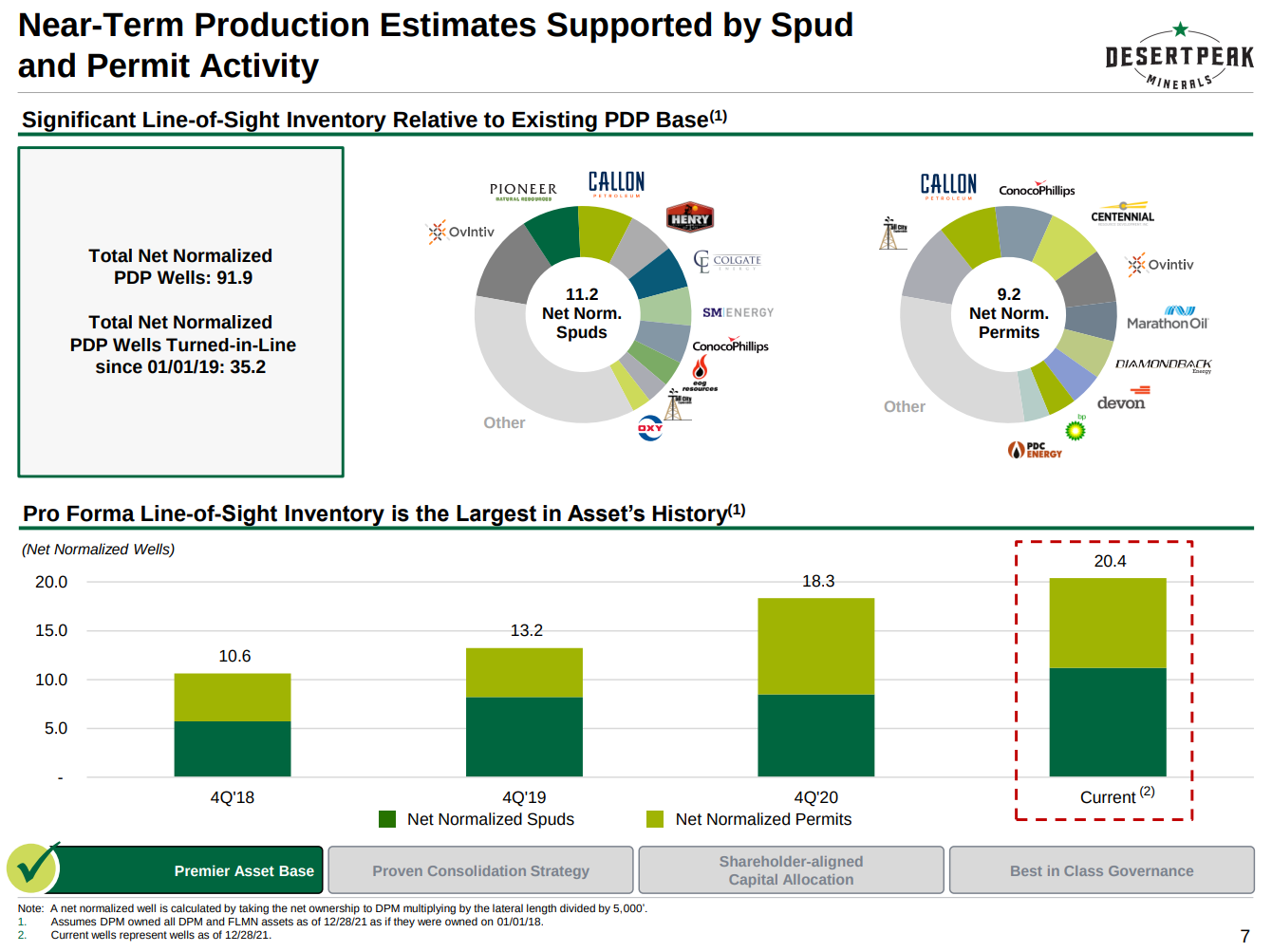

And luck would have it that FLMN has merged with Desert Peak, a large mineral royalty owner of Permian assets in an all stock deal on 12 January. To close the deal FLMN will issue 235 million shares to Desert Peak on top of their current 86m shares outstanding for a new share count of 321 million shares. And a market cap of $1.61 bn at the current share price.

Annualized Q3 2021 pro-form EBITDA would be $205 million for the newco (source). Since this is a royalty trust that does not have any capex needs, FCF will likely be ~$195 million. This assumes an average oil price of $70 and gas price of about $3-3.5/mcf. But most of its income (probably 75-80%+) will come from oil. Currently oil is trading at nearly $90.

Annualized Q3 ‘21 EBITDA of old FLMN was about $58 million, and FCF of $55m. So that means FCF yield will stay about the same. 75% of of Desert Peak’s Permian acreage is undeveloped. For more info on Desert Peak, they filed an S-1, as they wanted to go public last year.

The reason FLMN was cheap was likely because of its concentrated asset base with only 4 large companies operating it, with heavy dependence on just ConocoPhilips. It also repeatedly missed production growth targets because operators delayed drilling new wells on FLMN’s acrage. Now it will have more than 11 operators:

I think the reason it is still cheap after the merger is because dividend will be cut. At least if I have to believe these Seeking Alpha comments. Expected dividend was about $0.6-$0.7 per share for 2022 and $0.48 for 2021 for FLMN. FLMN newco will get Desert Peak’s management, and they plan to acquire more acreage in the Permian from small operators. Their incentive compensation will be 100% equity based.

The presentation did mention payment of a significant dividend.

Normally I would not get very excited about managers on an acquisition spree, but execution risk seems low as they are buying royalties, and not operating businesses and they are buying from small holders. And there are only a handful of competing buyers:

Additionally this trust is essentially controlled by a few large holders, Blackstone being the main one. So that lowers the risk of bad acquisitions as well. So I guess I am mildly excited?

And projected Permian production is likely to rise, while Eagle Ford is much more mature (source):

Conclusion

Once impatient dividend investors are shaken out, management does some acquisitions at a reasonable valuation and production steadily grows organically as well, this should nicely rerate to a similar multiple as the other Permian producers. FCF yield at current oil price of $85 WTI is about 15%. Dividend yield likely >10%. This is pretty insane for a royalty trust of this quality. Commodity price risk is much lower because they get a % of revenue, and they need to input zero capital to grow organically.

Assuming oil at $70 is a decent base case, and a 6.5% yield is reasonable, upside is about 80% to ~$9 per share. This would imply a recovery to FLMN’s 2019 share price. And a similar level as other publicly traded Permian royalty trusts. And best thing is, you get paid while you wait. So who cares if it doesn’t rerate, as long as I get my dividends every year I can wait!

Additionally, with all the talk of oil shortages, and a possibility of a Ukraine invasion, this seems like a really cheap hedge. You don’t get the same torque as with a producer, but you also get much less risk, and a better chance for rerating. The market is currently pricing in that current high oil prices will only be very temporary. This means getting all upside in oil prices above $65-70 for free basically.

So I am long at $5 per share and ofcourse as always, do your own work, and I may sell at any time.

Came to the same conclusion. I suspect holders were looking for something more concrete than "significant," but that will sort itself out soon enough.

It's an okay, not great price, but it basically resets the company with more liquidity and a new narrative, after they'd hamstrung themselves with commitment to a high payout that the market gave limited credit for (for the reasons you outline above). Now they have scale and can grow, for good or ill.

I think this is moderately good news priced as bad news.

I'm trying to square the fact that the P/E is 33x yet it offers a 13% dividend yield on reported numbers. In a run-off mode, will operators be able to continue production at the current rate for another 10 years? Or why do accountants want to amortise the assets faster, which I presume it's what's happening with earnings?