HK stock at 6x PE and negative EV

With possible hints of a special dividend coming

I have a new HK micro/small cap today. Buyable on IBKR. But rather poor liquidity of between USD$20-40k/day. It has a negative EV with an above average business attached to it and judging recent unusual volume spikes I think it is likely a special dividend could be paid soon. The last time a similar volume spike happened it was followed by a large special dividend months later.

First some updates. Nexpoint (NXDT) has seen more and more insider buying. And the “Big Beautiful Bill”, passed by Congress yesterday and now awaiting Trump’s signature, restores the FCC’s spectrum auction authority. I actually did not know they lost it in the first place. It does look like a spectrum sale will happen soon which will likely cause a pop in the stock (after which I will probably sell). Haven’t sold any shares so far though.

Closing Silicon Motion (SIMO) here at almost $75. I think stock has gotten a bit carried away here. Any increased tariff uncertainty and stock is back at $50-60.

Also closing Venture Life Group (VLG) at 60p. Shares are probably worth 70-80p but PE is a bit too high given the quality of the business. Making new acquisitions could take a while so cash has to be discounted, I think the stock will be stuck in this range for a while. Also don’t like that they are hiring external consultants to help with their acquisitions. Stock looks cheapish here, but there are better places to park my money.

Closing First Pacific (0142:HK) as well. Including dividends, the stock returned nearly 200%. It had a PE of just over 2x when recommended and a dividend yield of around 10%. Now PE is about 4x and dividend yield 5%. Still cheap, but given the fact that this is a South East Asian conglomerate controlled by a shady family with debt/EBITDA of 3.5x the situation looks nowhere near as juicy.

Medios AG (ILM1) announced a buyback for up to 1 million shares up to a price of €12.5. This is about 4% of their share count. It is pretty funny to see the negative sentiment around this stock on this German forum. It seems most of them do not even understand the underlying earning power and take IFRS earnings at face value. I would not be surprised if more buybacks followed. Kind of annoyed how this stock is still stuck here…

I sold completely out of Sesa Spa (SES). Stock is trading at just under 12x FW adjusted earnings. Fundamentals are slightly underwhelming and stock is up from where I first mentioned it. It was a nice trading stock as it traded into the 50’s twice. But here it is a lot less attractive. Reason I don’t close it is because I like to trade in and out of it as it dips and rises. Might be worth it to get a position before the annual Meeting on 27 August. It was hinted earlier this year that larger capital returns might be announced at that meeting. So far though other stocks in my list are crowding this one out.

New stock in question is Manpowergroup China (HK:2180). ADTV is about $50k USD in the last 30 days. But this stock can have days where no trading happens, so beware.

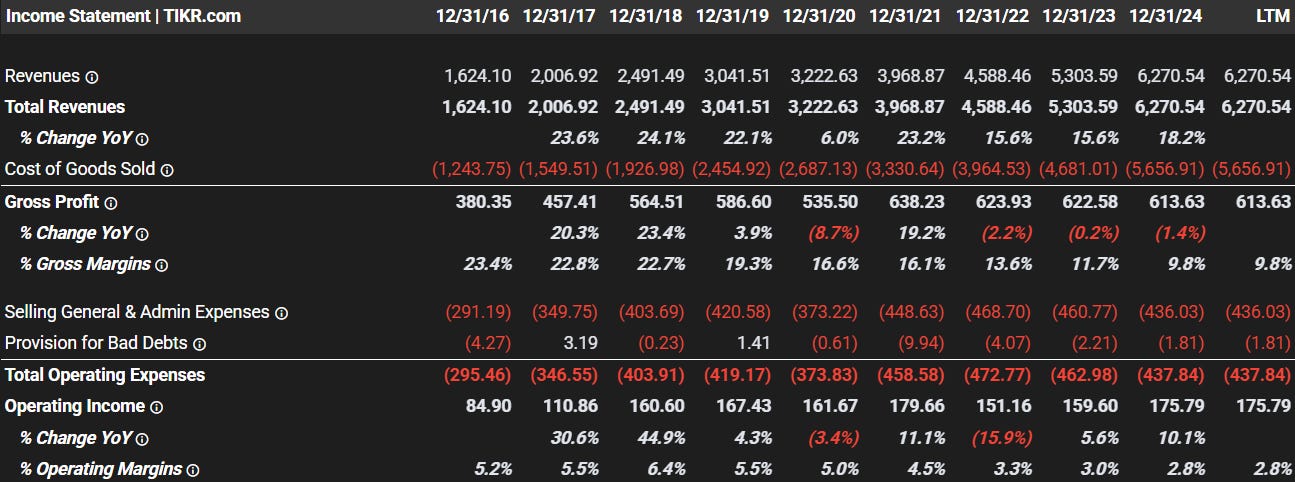

They are primarily a temp staffing solutions company. Market cap is just over 900-1000m HK$, while net cash is about 1.1bn HK$. Stock trades at a ~6x PE with growing revenue but shrinking margins due to growth in flexible staffing (which is lower margin) and a cyclical downturn in their higher margin recruitment solutions segment (figures in RMB):

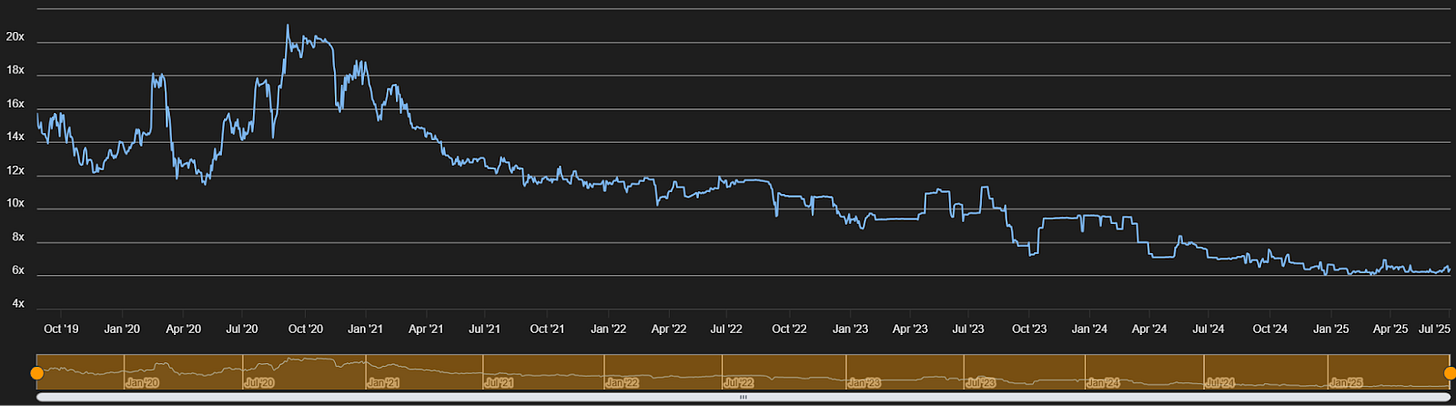

This is what PE multiple looks like since listing:

What piqued my interest was the recent unusual trading volume:

It is not a perfect signal, but I have noticed large volume spikes at ex-dividend date (especially green spikes that indicate someone wants to load up) tends to mean something is about to happen. In early March 2022 there was a similar large spike of nearly 8 million shares. And in August a large special dividend of HK$1.6/share was announced.

If this was some money losing shitco I would be less inclined to act on this, but there is a lot to like here:

~6x PE with growing earnings

ROIC is still fairly high well into the double digits (when backing out excess net cash)

~7% dividend while you wait.

Manpowergroup (MAN) owns nearly 37%, CITIC owns another 30%. I prefer this over some shady tycoon owning >50% who treats the company like his own private holding.

A buyout is not out of the question here as Manpowergroups ex China business on the US exchange is in a cyclical low and has seen declining earnings and revenue since 2021. Buyout of Manpowergroup China would boost their growth rate and margins.

There is a history already of special dividends.

Upturn in their cyclical recruitment solutions means stabilizing/increasing margins again.

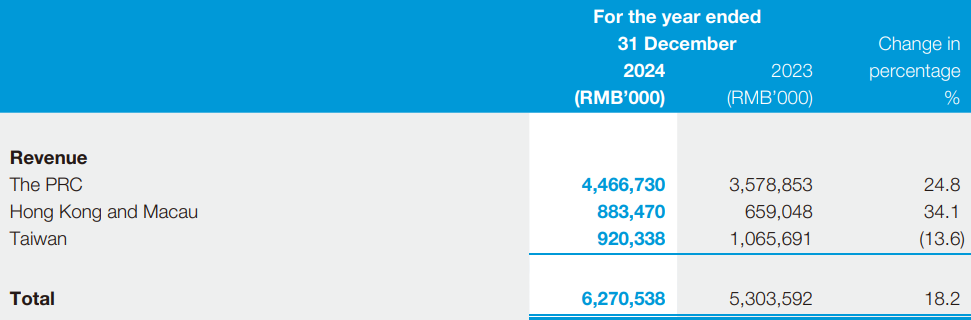

Geographical sales mix looks as follows:

Main risk here is that due to a greater amount of business with Chinese SOE’s receivables turnover could suffer. It has sat between 6-8x in the past 5 years, and is currently at the bottom of that range. So that is something to keep an eye out for.

Furthermore most margin decline is likely cyclical, but I think a small part of it is also structural. And AI could both be a risk and opportunity here. Those risks are more than covered by cheapness and the large net cash position though.

And obviously if China does go all-in with their stimulus this stock will benefit from that and PE could go a lot lower than 6x. Who knows when that will happen though.

Unless this is a really high conviction position, buying more than US$50-100k worth of shares is probably going to marry you to this stock as it regularly has days where it would not trade at all. Volume is kind of all over the place. Some days it trades 100k shares, and then 3 days no shares change hands.

Disclaimer: Readers of this blog should do their own due diligence before buying or selling any of the mentioned stocks, since I have been wrong before and cannot guarantee all information in this write-up is 100% factual. I may buy or sell the above mentioned stocks at any time. Past success is no guarantee for future success. Some of the stocks mentioned might have poor liquidity, so make sure to check average daily trading volume before buying or selling anything. I am not your financial advisor.

This is interesting but, having worked at SE companies in Japan that essentially act as temp staffing agencies, I can attest that they're extremely pro-cyclical. It's a bit like selling puts on the economy as a whole: you make a bit of money consistently, and then one day, you're bleeding badly from every orifice and trying desperately to just stop the bleed and preserve life. What are the labor laws like in HK? In Japan, it's very difficult to lay employees off, so essentially, temporary staffing is something of a booming business in any industry as a way of having a flexible workforce that can be downsized when/if projects become scarce. Staffing agencies, and small companies that act as pseudo staffing agencies, kind of earn money by bearing this risk. It's not the best of businesses to own or work in -- risky for owners, and the pay is often lower for employees, with the best ones often getting poached by clients. So you're kind of constantly replacing talent, bearing a lot of risk, and don't have much pricing power or anything resembling a moat. At least, this is the case in the Tech / Japan.

thanks for the update, have you looked at Talkpool AG? A service networks operator that looks cheap.