Natural gas royalties

A free lunch?

One of my favorite investment scenarios is when a sector has rallied already, but for whatever reason some corner of that sector hasn’t gotten the message yet and is lagging behind. I have found such a scenario in the natural gas market, in two publicly traded net profit interests in the same natural gas field: Mesa Royalty Trust (NYSE:MTR) and San Juan Royalty Trust (NYSE:SJT).

Both MTR and SJT came on the public markets about 40 years ago and are debt free royalty trusts with a net profit interest in the San Juan gas field located in Colorado and New Mexico. SJT has moved up in price already this year, while MTR has lagged behind. MTR trades at an all time low valuation, significantly below conservative estimates of NPV and will likely distribute around 30% of its market cap in the coming year if natural gas prices simply stay where they are.

The SJ gas field has about 20-40k wells depending on which source I use and is one of the largest and oldest natural gas fields in North America. A net profit interest means that SJT and MTR don’t put in any capital, they simply get a % of cash flow after production costs and capital expenditures (not including G&A or interest costs of the operator). If production costs exceed revenue, the difference is subtracted from potential future profits.

SJT has an interest in about 5400 or about 12.5-25% of the wells in this field. MTR has an interest in about 2800 wells or ~6-12% of those wells. But SJT gets 75% of profits of their net interest and MTR only gets 10%. Average production costs are about $1/Mcf for both trusts (not counting MTR’s Hugoton acreage). SJ wells of both trusts are mostly owned by Hilcorp who became the new owner in 2017. Hilcorp is a company that specializes in revitalizing old gas fields with new technology, and so far has been steadily recompleting wells in the area with some pretty good result according to this SJT press release from 2019:

“Despite low natural gas prices, Hilcorp believes the recompletions in the Capital Plan are sound economic projects. Hilcorp reported to the Trust that ten wells in the Capital Plan have been recompleted or are in progress as of the April 2019 reporting month, which corresponds to the June 2019 Trust distribution month. Well performance from the ten well recompletion package is exceeding Hilcorp’s initial expectations.”

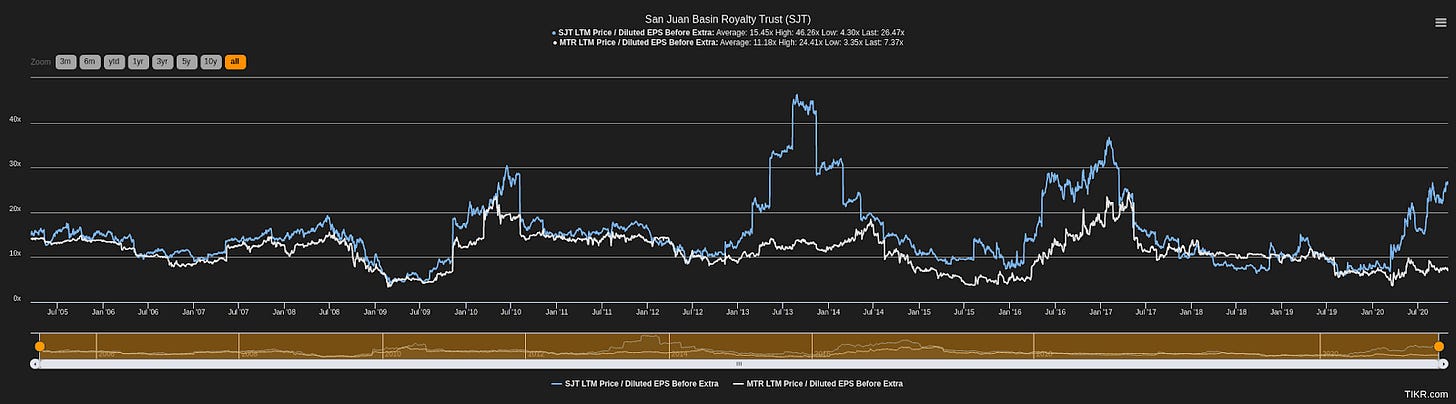

Until recently they traded at pretty similar valuations (caveat that earnings were depressed a bit by capital spending in 2019 for SJT and if adjusted, MTR trades at 60% discount instead of 73%):

The only other time this happened was in 2013. But in 2013 MTR traded at a 2-300% premium to NPV assuming $2.8 gas, while currently it trades at a 30% discount to NPV assuming just under $2 gas prices, while SJT trades at a nearly 200% premium. Moreover, NPV is likely understated looking at how they have changed over the past decade:

From 2010 to 2015 MTR paid out $26 million, while NPV stayed roughly even. And from 2015 to 2020 they paid out $10 million ($6.6 million of which came from the San Juan field). Considering lower assumed prices, reserves stayed roughly equal between 2015-2020. And about $18 million worth of discounted reserves were added in the last 10 years. More than the current market cap.

If we take 2008 and 2009 average production levels from MTR’s SJ field, which is about 880k Mcf, and 2018 and 2019 average production, which was 797k Mcf, production declined only about 1% per year. SJT saw a similar decline during that period.

If we adjust for capital expenditures spent then SJT generated about 72% of its market cap in the last 5 years while MTR generated 92% of its market cap in the last 5 years from their San Juan field alone.

A further point of interest here is the SJ Colorado property operated by BP. This had a NPV of only $300k in 2009 assuming prices of $2.24/Mcf. Since then it has produced $4 million in income for MTR and has more than doubled production (even growing in 2019) while growing its NPV to $2.1 million assuming only $1.52/Mcf! It has production costs of only $0.4/Mcf, so clearly this could become very promising as this field has some of the lowest operating costs in the industry.

Hugoton

MTR also owns a net profit interest in the Hugoton field of about 111k net acres and 413 net wells (vs a little over 30k net acres and around 300 net wells in the San Juan field). If we include income from this field as well, % of market cap distributed in the past 5 years rises to 139%. And this was while natural gas prices averaged $2.8/Mcf. To give an indication, nat gas futures for the next 2 years trade around $3/Mcf. While the current spot price is already over $3. But more on this later. This was only 3% of NPV in the 2019 10-k, but depending on where prices are, fluctuates between 1-30% of MTR’s reserves. This means it has significantly higher operating costs than the San Juan field and needs around $2.5-3/Mcf to be profitable. But it also gets better pricing than average.

So Hugoton could generate significant cash flow if gas prices simply stay where they are right now. In the past 5 years, it generated $4 million of distributions or more than half the market cap. This is a low decline gas field that will continue producing for a long time, and basically gives a free option if gas prices do rise. Since potential negative income from Hugoton is not subtracted from MTR’s other properties. In 2017 for example, Hugoton royalty income was 20% of the current market cap.

Natural Gas Market

So as value investors how do we take the price of natural gas in consideration? Obviously supply and demand will matter, but also takeaway capacity. Since they get pretty large discounts to Henry Hub pricing for especially their SJ Colorado acreage.

To start with supply, the current situation looks quite good actually. Here is an overview of natural gas rig count:

It is near all time lows, and will not be nearly enough to fill demand in the medium term according to this analysis and this analysis. Most companies in the natural gas market have large decline rates, so a large decline in rig count is usually followed by a large increase in price and vice versa. Since a lot of drilling is needed to keep supply steady. On top of that it seems that a lot of gas producers have stretched balance sheets and investors that are a lot more interested in actual free cash flow, compared to a few years ago (when EBITDA was the favorite metric).

Then there is also associated gas (side product of shale oil drilling) which has grown to ⅓ of US supply in the past couple years:

And with current oil prices, shale oil production growth has come to a halt. This is very bullish for MTR since associated gas has depressed prices, and in the case of the SJ gas field, also created a discount due to constrained takeaway capacity, since it is located near the Permian. But takeaway capacity will increase significantly by early 2021 according to this article, and supply will likely decrease in the coming 2 years due to the massive oil glut. Pricing discounts have already reversed quite a bit for the next year for this reason, which has a big impact on MTR’s Colorado property, as they get nearly double the revenue now.

Large portions of shale oil need $45-50 oil at least and currently oil trades under $40 with still a massive overhang of supply. So it looks like all the stars are lining up to significantly depress natural gas supply at least in the near term. Which is good because demand will be down about 5% this year, depending on what source you use. Although long term demand should be quite healthy.

What is interesting is that oil and gas markets are becoming inversely correlated because of associated gas. Effect of commodity prices could be hedged by buying a cheap royalty stream that is mostly exposed to oil. Since there are quite a few of those trading rather cheaply currently. Some interesting candidates exposed to low cost oil fields are Dorchester Minerals and Falcon Minerals (do mind potential withholding taxes though).

Worth noting here is that another consequence of the large decline rates of North American gas wells is that cycles don’t last that long. So current pricing will likely not last more than 2 years when another wave of supply will come on again. Looking at the past decade, up and down cycles seem to last about 2-3 years tops. But that does not matter much if you retrieve 50-75% of your investment in distributions during an up cycle.

To Hedge or not to Hedge

A possible trade here could be to short SJT and go long MTR. The problem with this is that there could be short term variations in distributions due to capex spending. This could have a significant impact on the share price as well if distributions were to grow relatively quicker for SJT than for MTR. And we need to pay short interest and potential taxes on distributions.

Since MTR is cheap enough on its own, has no debt, is trading at a historically large discount to NAV and is far less risky than investing in an E&P outright, I think just going long MTR is attractive enough on its own. Plus the SJ properties seem to have low enough operating costs that lower gas prices aren’t too much of a problem. Average gas prices in 2015, 2016 and 2019 were around $2.5 (where a significant portion of the gas producers lose money), and distributions were still around $1.5m per year. That is a 20% yield! Obviously distributions will go to zero if gas prices are closing in to $1 since there are no hedges. At current average prices of $1.9/Mcf it seems MTR yields about 8%.

If Hilcorp would go in chapter 11, holders of MTR would barely notice it. Since these fields change owners on a regular basis. Plus with current gas prices, distributions will likely be restarted in a month or two, since distributions lag a few months behind.

Additionally, MTR has cash reserves to pay G&A expenses for the next 5 years if they were to get no income from their interests. SJT only has a few quarters worth of cash reserves. So if gas prices stay below $1.5 for more than 6 months, SJT could get into trouble and maybe have to issue new units.

So to conclude, I think the margin of safety here is that we are low enough on the cost curve combined with the fact that low natural gas prices are priced in currently, while all the stars are lining up for a natural gas bull market.

Disclosure: I am long MTR

Further relevant reading:

https://www.naturalgasintel.com/information-about-the-san-juan-basin/

https://btuanalytics.com/natural-gas-pricing/san-juan-gas-production-declines/

This was a beautiful time to enter oil and gas royalties!