Origin Enterprises

Agri-services company at 6x earnings returning capital

I wanted to put this article behind a paywall, but there are some technical difficulties (credit card amount showing up as 0) that I have to sort out first. Since the stock has run up a bit from where I wrote it (at €2.8/share), this one is on the house.

The company’s name is Origin Enterprises (OIZ) and trades on the Irish stock exchange at a PE multiple of ~6x. I would describe them as an agri-services/product mini conglomerate (they have made a fair number of acquisitions over the years). There has been quite a bit of insider buying, and they are aggressively returning capital.

OIZ has been consistently profitable with somewhat unstable margins, and 2024 will likely be a bit of a down year (click to enlarge):

The business can be split up into landscaping (supplies), farming services and products and ecology and environmental services. The landscaping and ecology/environmental services businesses are:

This seems to be their higher margin growth segment, although it is hard to tell how much of it is organic growth (from their FY 2023 presentation):

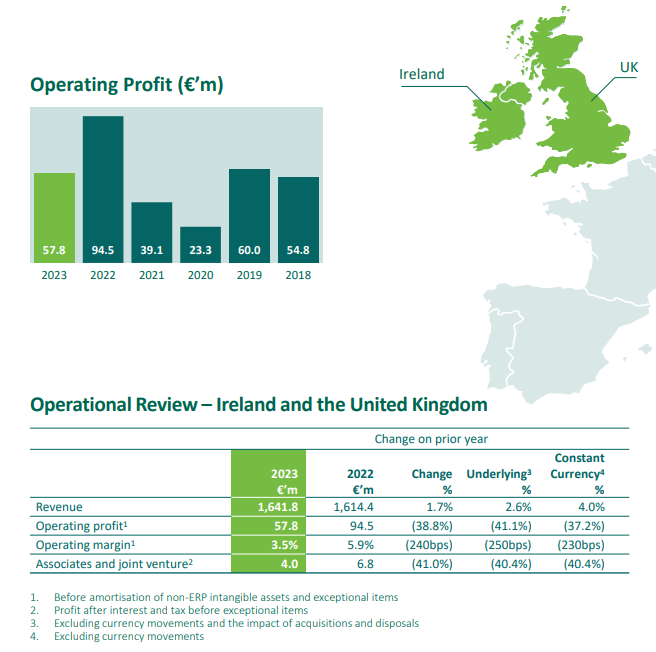

Their overall UK & Ireland farming related services and products:

Their Continental Europe segment seems to be mature and non-growing with stable margins. This is farming related as well (They have exited Ukraine recently, which was a very small part of their business anyway):

Then their Brazil segment (mostly fertilisers by the look of it) seems like a growth area, they are planning to aggressively expand capacity there:

Return on tangible invested capital is quite good overall at about 15% in 2023. Note that amortisation of customer relationships and brand is €8-9 million a year. They are heavily investing in growth and integration of their acquisitions. It is possible there will be some growth beyond 2024 from synergies of their various acquisitions and margin recovery in their farming segment. Results are a bit worse when food prices fall and vice versa.

Normally I would not get too excited about a company like this. Yes it is a business that will likely exist in slightly larger form 10 years from now, and yes it looks cheap. But it likely won't trade for more than 9-10x earnings. In fact they have not traded above 10x earnings since early 2019.

What did peak my interest, is that they are aggressively returning capital to shareholders. The company has returned a third of their market cap to shareholders in the past 2 years. Their share count has declined by roughly 20% in the past decade, dividend yield is 5% and there is quite a bit of insider buying, aligning insiders with minority holders (Sean Coyle is the CEO):

TIKR forecast for FY 2025 (starting in August this year) and FY 2026 is €55-65 million of free cash flow/year. Assuming they buy back another 10 million shares over the next 2 years, that means about €0.55-0.65 of adjusted eps. With only a modest amount of net debt at ~1.35x EBITDA. At a 9-10x multiple that means almost a double including dividends.

The main risk is that they go on another acquisition spree. In the past decade they have spent about net €200 million on acquisitions. This has not increased operating profit much. In the past 3 years average adjusted EBIT was ~€86 million, while from 2012 to 2014 average adjusted EBIT was ~€68 million. The current CEO Sean Coyle has been with the company since 2020, which coincided with a sizable increase in capital returns. So I don’t think this is a big risk.

You could also see this as a glass half full thing and assume there is room for margin improvements. Since their gross profit did increase by ~50% in the past 10 years. So who knows, there might be some room to cut costs, and there might be some untapped revenue synergies? And there might be some cyclicality at play here as well. Either way, the stock is cheap.

So I have decided to take a medium sized position in OIZ at €2.8/share. Currently the shares trade just above €3, where they are still a good deal.

Disclaimer: Readers of this blog should do their own due diligence before buying or selling any of the mentioned stocks, since I have been wrong before and cannot guarantee all information in this write-up is 100% factual. I may buy or sell the above mentioned stocks at any time. Past success is no guarantee for future success. Some of the stocks mentioned might have poor liquidity, so make sure to check average daily trading volume before buying or selling anything. I am not your financial advisor.

Very nice write-up. Irish based OGN shareholder here. I did a write-up on it ages ago which you may find interesting. Two angles in particular worth calling out are Brexit and ESG (sustainable farming practices). Totally agree with your capital returns thesis https://tbifund.wordpress.com/2021/08/14/origin-enterprises-ogn-id-green-shoots/

Thanks for the write-up. We use to own this back in 2018 but sold on concerns with leverage. One thing to just be aware of - they have a funny year (July 31st). This is because the business has huge NWC needs and this year end is when NWC is at a low point. The implication of this is that average debt and average invested capital is much higher the rest of the year - which increases both the leverage profile while lowering the ROIC. Not a fact that kills the investment but just something to be aware of when thinking about those two things.

This was the company that actually made me add the following item to my accounting checklist: "If the company has an abnormal year end, ask how average debt and NWC compares to year end figures. Also understand they they chose that year end" ... although not always, company's will often choose funny year end dates with some motivation in mind.

Thanks again for the write-up, your posts are great.