Pagseguro, a cheap compounder?

Brazilian Fintech leader for 8x earnings

I was complaining recently that I couldn't find any cheap stocks, but I will take that back! I got another one, Pagseguro (PAGS). A Brazilian payment processor and online bank and potential compounder.

PAGS trades at about 8x through earnings, has been growing quite rapidly and could see explosive short term earnings growth if they can bring down their financing costs. And they can expand their EBIT margins as Gross profit seems to grow faster than their operating costs. Benefitting from, what I like to call, the Holy Trifecta of value investing: Margin expansion, Multiple expansion and Revenue growth.

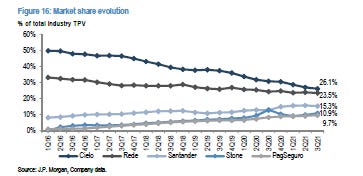

The company has been taking share away from the two incumbents, Cielo and Rede together with Stone by targeting underserved micro and small merchants:

And they don’t really need to undercut their competition in pricing to take this market share (from their Q3 2022 presentation):

PAGS pulls this off by offering faster payment processing times, and offering a complete one stop shop solution for merchants through PagBank. Their superior and more nimble tech stack is hard to replicate by the more bureaucratic incumbents, who instead seem to milk their business for as much cash flow as they can, while they slowly lose market share.

The stock was quite popular during the pandemic, trading as high as $60 vs $8 now, at a valuation of 50x earnings. Despite benefiting from likely unsustainably low interest rates back then.

Which brings us to the main cause for the cratering share price, rising interest rates. They have jumped from about 2% in 2020 to 13.75% now:

This was in response to a Covid related inflation spike, which has since come down to just above 5% (actually lower than the US!):

Those high interest rates directly affects their payment processing segment, resulting in a collapse of net profit margins:

But the underlying business is quite healthy with stable Gross profit and EBIT margins, showing rapid double digit growth. Having all the Hallmarks of a compounder.

With inflation declining at 5.6% and rates at 13.5%, it seems likely that somewhere this year or next year, rates will come down at least somewhat. Even if they are not, PAGS also has been able to use their Pagbank deposit base to lower their financing costs. And will likely to keep doing so in the future since their deposit base has shown 134% growth since Q4 2021. Additionally they will further increase their pricing.

Say that EBIT grows another 15% in 2023, and rates come down from 13.5% to 10% later this year, that would imply annualised net profit of $550m by the end of 2023 (assuming the Real stays stable against the dollar). Which would mean the stock only trades at about 5x forward earnings! Which is pretty cheap for a company that was only recently trading at 20x+ earnings and is growing this rapidly.

Risks

One obvious risk here is currency depreciation. The Brazilian Real has been cut in half in the past decade against the dollar. Which implies earnings needs to grow at least 7% per year + inflation to break even. So far that has not been a problem as PAGS EBIT measured in USD has been able to grow much faster than that, at a rate of more than 30% since 2017. But it does illustrate that you really need to buy cheap in countries like Brazil.

A counterpoint against this is that the Real is quite cheap currently, and this decline came from a high point where the Real was arguably overvalued by 30-40%, so the 7% figure is probably a bit too conservative:

Brazil’s real GDP growth has also been not great. Collapsing from $2.6 trillion in 2010 to about $1.6 trillion right now. And the current economic outlook isn’t that great, with a left wing president in power, with a history of corruption (but counterbalanced by a conservative congress).

Again the strong dollar has to be taken into consideration though. Since just about every currency has declined against the USD in this period. Which would make the GDP decline less dramatic when compared to a basket of currencies.

Then finally the company is effectively controlled by billionaire Luis Frias. Who owns a 39% economic stake, but controls 88% of the voting through supervoting shares. He seems pretty involved and competent judged by his past success. But this is obviously going to be a deal breaker for some. Especially now that a lot of shine has been taken of these “mythical” tech founders who have an iron grip on their companies, like Elon Musk and Zuckerberg.

Conclusion

Really the main reason this is cheap is high interest rates. When your hurdle rate stays at 13.75%, 8x earnings isn’t really cheap. So obviously they have to come down at some point, and earnings will have to grow for this idea to really work. If inflation again increases (See the 90’s and early 2000’s) rates could go far higher than they are now. That is really the main risk here. But I think the odds of this happening in the short and medium term are low.

With real rates at 8%, and inflation coming down to low single digits, downward pressure on rates is far greater than upward pressure. Brazilians are underbanked, e-commerce is likely to grow much faster than GDP in the foreseeable future, and PagBank is still under monetized. With half the number of users as Nu Bank (NU) which is valued at $20 billion vs PAGS market cap of $2.7 billion.

I only looked briefly at StoneCo (STNE), their main competitor. The main differences seem to be that they focus on larger clients and don’t have a banking segment. And they are more focussed on software, with SaaS revenue being about 10% of its market cap.

They have grown faster, but PAGS seems to have a cost of funding advantage with lower financing costs and actually has pricing power over STNE. And trades at a much cheaper valuation. If revenue growth levels out for both, and interest costs come down, I think PAGS will do better.

Obviously if STNE continues to grow faster, then in the long run STNE will do better. But I am not really a growth investor, and TIKR forward estimates show similar estimated revenue growth. I also don’t really know these types of businesses inside out, so that is why I like PAGS better.

So for all the above reasons I have taken a position at $8.3/share in PAGS.

As usual, do your own due diligence before buying, and I may sell my shares at any time.

I appreciate the thinking - long PAGS - second largest position representing 14.9 pct of my portfolio. The growth re pix from both a macro perspective and company specific one is noteworthy, generally speaking - now absorbing 10% The nations transactions speaks volumes regarding their growth trajectory and potential flexibility looking ahead. From my recollection, they were at 2% a couple years ago - I see Pix as a an underrated intangible positive iin light of Brazil, being so underbaked as you pointed out - it’s a useful metric of trajectory and A sponge that gets you in the door.

When stocks move up and down, perhaps staying down for longer than one might imagine, There are no rules nor reason - however it is pretty unusual to find growth and value heavily discounted. on top of this, if and when these kinds of remarkable equites Display more signs of leading their peers than not, much less moat potential(I don’t see a moat here yet) a run usually comes.

1. CLS

2. PAGS.

I know u don’t want more china exposure but can you help me out with $NISN. It is a net net that’s trading at pe of around 1 and is also PCAOB approved. It also won a fraud case.

They also have a couple negatives, they once placed new equity under the share price on the open market, they also openend a new trading segment that’s way lower margin, they also get delisted soon if they don’t do reverse split soon and most importantly they are really bad at communication.

I don’t get why they are trading so cheap, so I hope u can take a look at it and make some sense why they are so cheap Or is it simply because they are Chinees.