Platform biotech with 2 approved drugs

A mispriced lottery ticket

Not a Chinese stock this time but a US traded Israel based platform biotech company with 2 approved drugs, and multiple drugs for rare diseases in its pipeline. The CEO purchased a sizable chunk of shares late last year at a higher price. The company has a net cash position.

Milestone payments alone for their second approved drug a year ago could be up to 11x the company’s market cap. The company is currently profitable. The market does not price in management’s base case scenario of taking 15-20% market share despite this drug outperforming the very limited competition significantly in efficacy and side effects.

Disclaimer: Readers of this blog should do their own due diligence before buying or selling any of the mentioned stocks, since I have been wrong before and cannot guarantee all information in this write-up is 100% factual. I may buy or sell the above mentioned stocks at any time. I am not your financial advisor. Past success is no guarantee for future success. This stock is more on the risky side due to being a biotech, so beware.

The company name is Protalix BioTherapeutics (PLX). It has a ~$90 million market cap with $25 million in net cash. Their two approved drugs are Elelyso for Gaucher disease with about $20-25 million in sales (which seems to have levelled off) and Elfabrio for treatment of Fabry Disease which was approved by the FDA in May last year.

Elfabrio, which is superior to its competition in various ways, had $17 million in sales last year and if it takes 20-25% market share it could generate $120-150 million/year in royalties to PLX assuming the market grows to $3 billion by 2030 (currently just over $2 billion).

Royalties vary between 15-40% of sales of their partner Chiesie. Protalix manufactures the drug and gets paid in royalties by selling it to Chiesi who then distributes it. My estimate of gross margins are somewhere between 70-95% depending on royalty %. It is hard to estimate this, but since Elfabrio product revenue has gone up, gross margins significantly expanded. So I think 75-95% is a reasonable estimate.

Then there are about a billion $ in milestone payments on top of that if various undisclosed sales and regulatory targets are hit. Given that most of that will flow to the bottom line the company could generate its entire market cap in cash in a single year within the next few years.

Elfabrio vs the competition

Fabry disease does not have a cure (edit: I found out much later Sangamo does in fact have a very promising Gene therapy in phase 1/2 that might be fast tracked) and patients need regular shots of enzyme replacement therapy to prevent heart and kidney failure over time. Elfabrio really only has 2 competitors in the EU and 1 in the US:

So why would Elfabrio capture significant market share? Well there are three metrics to score which drug is better (source presentation found here):

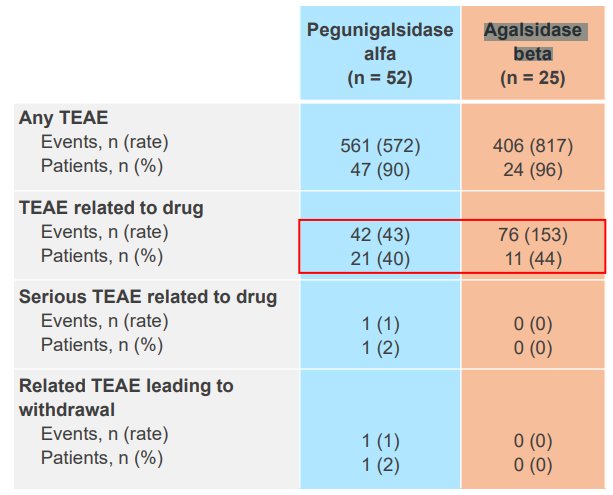

Treatment emergent adverse effects (TEAE), in this regard Elfabrio beats the competition (Pegunigalsidase is Elfabrio and Agalsidase is Fabrazyme):

Note how blue sample size is twice as big, but the amount of TAEAs is only 38% higher in total. And TEAE related to the drug is actually lower despite the larger sample size.

Infusion-related reactions (IRR), here Elfabrio scored 4-8x better than Fabrazyme:

Examples of IRRs are generally fevers, headaches, vomiting etc. Not unimportant when you need to inject the stuff about a 100x per year.

Greater reduction in antidrug antibodies (ADA+) and neutralising antibodies (nAb+) than Fabrazyme. This is good because it means a better uptake of enzymes, which means better efficacy and fewer side effects and a better disease outcome:

Then there was another study that caught my eye where patients switched from Fabrazyme to Elfabrio with the following results and a sample size of 20 people:

I don’t know about you, but if I had Fabry disease I’m pretty sure I would at least give Elfabrio a try. Most of the patients in the trial seem to agree as even most of the Fabrazyme users ended up switching to Elfabrio.

Then there is also the possibility that Elfabrio would only have to be administered once every 4 weeks instead of once every 2 weeks. It is a bit unclear to me if the company is still actively pursuing this (edit: the company is in fact pursuing this, outcome expected before November 2025).

Furthermore the national institute for health and care excellence (NICE) in the UK estimated that cost savings of using Elfabrio over Replagal or Fabrazyme (they are both very similar) could be nearly £500k over the lifetime of patient treatment. The whole document is worth a read if you made it this far and the stock has caught your interest.

The platform

What I like about this company is that they don’t seem to be a one hit wonder, but have a platform called ProCellEx with which they have gotten two competitive drugs through approval so far. The company describes it better than I could in their 10-k:

ProCellEx: Our Proprietary Protein Expression System ProCellEx is our proprietary platform used to produce and manufacture recombinant proteins through plant cell-based expression in suspension. ProCellEx consists of a comprehensive set of proprietary technologies and capabilities, including the use of advanced genetic engineering and plant cell culture technology, enabling us to produce complex, proprietary and biologically equivalent proteins for a variety of human diseases. Our protein expression system facilitates the creation and selection of high-expressing, genetically-stable cell lines capable of expressing recombinant proteins. We plan to execute on our strategy by developing tailored complex recombinant therapeutic proteins primarily produced through ProCellEx while genetically engineering and/or chemically modifying the proteins pre- and/or post-production. We intend such engineering and modifications to provide added clinical benefits by improving the biological characteristics (e.g., glycosylation, half-life, immunogenicity) of the therapeutic proteins.

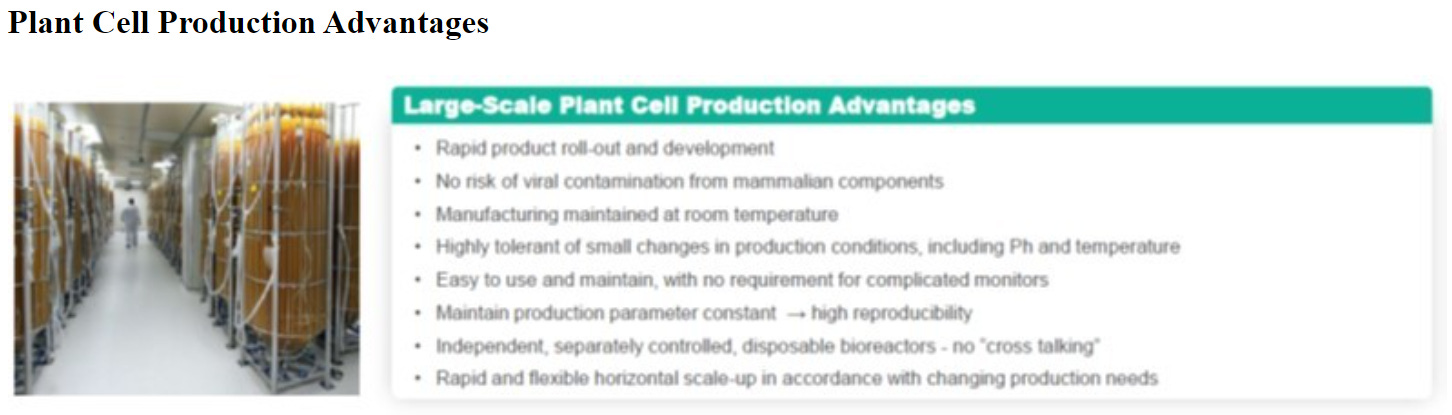

Our ProCellEx technology allows for many unique advantages, including: biologic optimization; an ability to handle complex protein expressions; flexible manufacturing with improvements through efficiencies, enhancements and/or rapid horizontal scale-ups; a simplified production process; elimination of the risk of viral contaminations from mammalian components; and intellectual property advantages.

We developed ProCellEx based on our plant cell culture technology for the development, expression and manufacture of recombinant proteins which are the essential foundation of modern biotechnology. We develop new, recombinant therapeutic proteins by using the natural capability of agrobacterium to transfer a DNA fragment into the plant chromosome, allowing the genome of the plant cell to code for specific proteins of interest. The agrobacterium-mediated transformed cells are then able to produce specific proteins, which are extracted and purified and can be used as therapies to treat a variety of diseases. We are the first and only company to gain FDA approval of a protein produced through plant cell-based expression, and with the recent approval of Elfabrio, we now have two commercial proteins produced through our platform.

Manufacturing drugs developed through their plant based technology has several advantages as listed in their latest 10-k:

Platform biotechs should in theory fetch a premium, especially if they have proven their platform as Protalix has. It should increase the odds they will be able to successfully develop more non biosimilar drugs. In fact Protalix does have a drug going through phase I now called PRX-115 for the treatment of severe Gout. This is a $3 billion market and results of the trial will likely be published somewhere in Q2 2024.

Then they also have PRX-119 for the treatment of NETs-related diseases. This drug has not entered phase I yet.

I don’t put much weight into this, and clearly the market also does not. But it does add some upside optionality. This company might not be a one hit wonder that got lucky, but might in fact have a significant pipeline of exciting rare disease drug treatments. This quote from the CEO Dror Bashan in the company’s June 27th 2023 presentation seems to confirm this:

“And the vision, if we look 5 and 8 years down the road, we plan to work, I hope with a lot of brainstorm and consultation and some brain, if I may say. And hopefully, with some success as well in order to build a significant pipeline with multiple clinical rare disease programs, it will be a fully integrated company. The intent is indeed to have down the road and again, I'm speaking about beyond the next 5 years, also commercial infrastructure to support the novel products or the new products and to leverage our technology platform that we will collaborate with.”

If Protalix is in better financial condition, if Elfabrio does indeed become a big hit, they would not need to do a deal like they did with Chiesi and keep much more upside for themselves for future drugs by building out their own commercial infrastructure and this could become a really nice compounder. I don’t put much weight into this for now, but it is nice to have the optionality.

Risks

This stock is somewhat on the risky side and behaves a bit like a long term option. Basically the more market share Elfabrio takes the higher the royalty % which means higher margins. Say it takes 35% of a $3 billion market at 30% royalty rate, that is $315 million in revenue to PLX with 90%+ gross margins. This would make the stock a homerun. I can imagine that this would also trigger at least several $100 million in milestone payments.

But if Elfabrio only takes 10% market share at a 15% royalty rate of a $2.2 billion market that is only $33 million of revenue at probably 70-80% gross margins. They don’t disclose when exactly more milestone payments will be triggered so this is kind of a wildcard. In this scenario there might be further dilution and the stock will probably trade down from current share price if revenue stays at this level.

Another outcome is that we do ok here with say 15% market share and a 20% royalty rate of a $2.5 billion market which would be about $75 million in revenue at probably about 75-90% gross margins? But the company spends it all on potentially new dead end R&D programs. Current opex burn rate is about $30 million/year. But if that is ramped up significantly (they do mention trying to get 5-6 new drugs to phase II in the next few years on page 11) then there might not be much profit left over for shareholders.

If some of those R&D bets work out this could become a multi billion $ company and the stock could be a 30-40 bagger. It could also become a value trap that will not end up making much profit. The range of outcomes are pretty wide here.

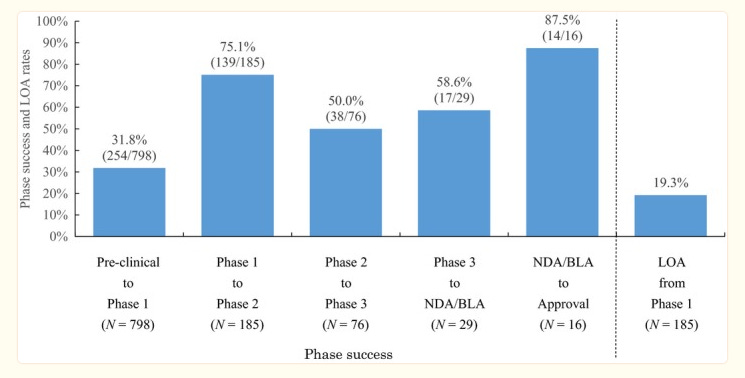

I found this study which shows the base rates of making it through the various phases:

This implies any Phase 1 drug has a 20% chance of being approved in the end. Although it might be higher for Protalix due to their platform and track record. It might also be lower. Here is another study showing lower odds of 11% (PLX 115 for Gout probably falls under autoimmune):

A mitigating factor here is that it is likely that the majority of PLX’s potential new drugs will not make it to phase I, limiting R&D spending (phase III is most expensive). Additionally the company is well incentivized to build up financial reserves so they don’t have to give away a large chunk of profits on their next big hit. So I do think there will be sizable profits until the company has built up a significant financial buffer before any R&D spending spree happens.

Another risk is that their production facilities are located in Northern Israel in Karmiel which is a 40 min drive to Lebanon. There have been almost daily bombing campaigns against Hezbollah in Southern Lebanon from Israel and so far the Israelis have been able to defend their border reasonably well on that side.

A large ballistic missile attack from Iran could also destroy PLX facilities if Israel decides to escalate against Iran. I think these risks are very small especially in the short and medium term and PLX facilities will not be a primary target for Iran obviously. But it is something to keep in mind.

I like the risk/reward here so I am long shares of PLX at about $1.2.

Interesting observation published in journal of int Urology and Nephrology

https://stocktwits.com/milt0n/message/570185331

Careful buying this stock btw. Could get quite volatile if there is a delay in ramping up revenue. It might take a while as a lot of people might be very used to their current treatment. I started small, and will add if it goes below $1 which it very well could if Q1 is weak.