Some new stocks

Patience is required

I added some new holdings to my portfolio. So much cheap stocks laying around. There is more, but I did not include it because the post would get too long.

I don’t really see what all the fear is about really. If you buy good stocks, and have patience, you will probably be rewarded over the next few years. Inflation is likely to go down to 3-4% by the end of next year at least for the US, and unless Putin nukes us into oblivion, earnings will keep coming in, and over time fear will subside and cheap stocks will get repriced.

So if you have a 2-3 year time horizon, there are some amazing bargains laying around now.

Vontier

First one is Vontier, its main business is a duopoly in gas station equipment and software. Repair tools for ICE vehicles. Software and hardware for car washes, and some smaller miscellaneous businesses. Some of which they will divest for probably several $100 million in proceeds. And they have a piece in EV charging infrastructure as well.

The stock trades for about 5-6x NTM earnings with very high ROIC (not counting intangibles), with pretty high earnings visibility. Obviously the fear is a major downturn which causes a cut in capex spending.

I think these fears are overblown. Gas station stocks like CASY, MUSA and TA haven’t really crashed. And longer term, EVs are really only going to affect earnings growth negatively in the 2030’s. This pretty optimistic Metaculus prediction on # of EV’s on the road by 2030 is still only 9%. Likely ICE car sales will not peak before somewhere around 2025, as total car sales will also grow:

Besides, they have exposure to EV charging stations. And electric cars still need to be washed. Their car wash segment is actually sizable and growing rapidly. And I don’t think diesel trucks will be going anywhere anytime soon. Since charging times are far too high for most trucks.

So it seems like a decent bet here. Except I bought too soon at about $20/share. More detailed write-up here.

Extreme Networks

This stock isn’t super cheap at about 13x NTM FCF, but ROIC is really really high. So it will generate a lot of cash while growing. And their backlog is exploding so this means very high earnings visibility. Multiple is the same as Cisco and Juniper, even though growth is going to be much higher for EXTR. Two years from now FCF will be somewhere between $1.6-2.3/share. So it seems like a safe bet? I take this position to 10-12% as this gets to about $9, but selling about half of my position in the $13-14 range.

I’m not sure if it qualifies as a compounder in the long term. But in the next 3-5 years they will definitely be extremely dominant with expanding margins.

I have written the stock up in more detail earlier this year.

Toya

This continues to be in my portfolio. Even added some between 5-5.4 in the past months. Assuming earnings decline by 30% (estimates for Makita are -15% for 2023) this is still trading at a 6x PE. And if that happens, the company will likely release working capital, which means a lot of FCF. Which increases the odds of a dividend at some point. Also their tools are made in China, which is experiencing deflation right now.

And I am not so pessimistic in the long run. Rebuilding Ukraine is going to need a lot of tools, and Toya will be first in line to take advantage of that. Additionally there is now a housing shortage in Poland. Those 3 million Ukrainian refugees will probably boost Toya’s Poland revenues?

Either way the stock is very cheap, and it does not take much good news here to send the shares up. Maybe even a management buyout at some point? Meanwhile it is a forgotten dead stock, but I think patience will be rewarded.

Westrock

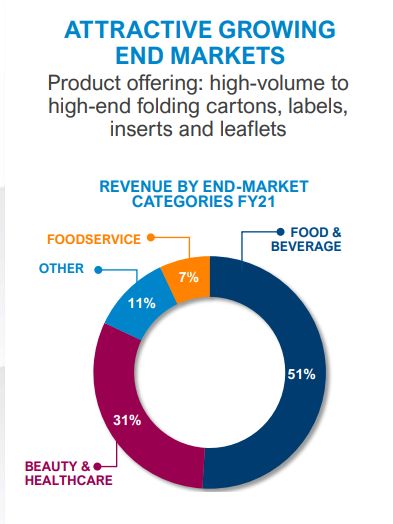

Maybe I am naive, but I am not getting the pessimism here? These cardboard box companies usually sail right through recessions. Most of Westrock’s revenue is non-cyclical consumables:

And pricing power is steadily increasing as the industry consolidates, even in downturns. Even if all their 50k employees get a $10k raise, they would only need to raise prices by 2% to compensate for that. And could easily be offset by the promised efficiencies. Their recycling segment (35% of revenue) could benefit from plummeting OCC prices even. As a plain cardboard box plant cannot make completely different boxes on the flick of a switch. Or am I being too optimistic again?

So whatever is happening to Fedex does not seem terribly relevant? Yet the stock has done worse than PKG, which has far more exposure to e-commerce, and possibly over earned in 2021 and 2022. Modest sized position for me now.

Cipher Pharma

Pretty good VIC write-up here. Several good reasons why this is cheap. Probably some people forget to convert USD to CAD? And the company is not paying cash taxes because of its NOLs, but still registering a tax expense. Market cap is $58m, net cash of $24m.

Epuris revenue is actually steadily growing, despite this drug being off patent. It is too expensive for a market this small to get through the FDA process. Recently the licensing agreement has been extended to the end of 2026.

Between now and 2027 they will probably generate $40-50m in FCF. And then there is MOB-015 which could be a home-run. Cipher has Canadian marketing rights. So this is basically a free option.

Current product on the market, Jublia, doesn’t work all that well and has 90% market share in a $75m/year market. MOB-015 actually cures nail fungus much better, but it discolours the nail. So now Moberg is trying on a lower dose. If it works, the stock is probably a home-run.

I bought this stock at $2.5 though, and now I am not sure what to do with it at $3.25. It can take another 2 years for them to see revenue from MOB-015 if it works out, and meanwhile other stocks are getting cheaper. So I might sell this one. OTOH, the company has recently announced a large buyback.

I peg the value of Cipher excluding MOB-015 at around $4-4.5 CAD/share excluding MOB-015. But I have a hard time assigning a probability on MOB-015 paying off big.

Oil stocks

I quite like oil stocks, despite the recession fears. Several reasons, there will be gas to oil switching in Europe. Current oil prices are where they are despite the US government selling 1m barrels/day from SPR. They have committed to buying 1m/day if oil goes below $80. A potential 2 million barrel/day drop in supply is nothing to sneeze at. And despite constant major Chinese lockdowns this year oil prices have stayed high.

Then there is Russia, which has every incentive in the world to keep prices high. As the Ural discount is still around $20-25/barrel. China does not really seem to want to get dependent on Russian oil it seems. And their production will likely decline long term due to sanctions. And meanwhile the frackers are not really going to save the day, as they are still not growing production more than 5-10%/year.

So the stars seem to be aligned to keep oil prices high here. And oil stocks are pretty cheap. I actually got back into Petrobras, as it is just too cheap here as it seems Lula has given strong indications that he will likely leave the company alone.

I think Lula not messing up the company when he gets into power + more dividends will be a nice catalyst in 2023.

Additionally added back to Sitio royalties, after selling most of it at $28-30. Another merger was announced recently, which means they will have even less competition when buying up royalties. At $80 WTI still about $3.5-4/share in FCF. So this means a dividend yield of >10%.

Tim S.A.

This is getting a bit long here, so I will be quick. Made this a medium sized position. I might add to it some more. I actually found out that the company has an English language website. Is that new? Or was I just blind?

They even have an English presentation. Stated goal by 2026 to have revenue of 3 billion and EBITDA of 250m. That implies a PE of about 3x. Also gives a nice idea of what they think normalised margins will be. Meanwhile you get a 8%+ dividend while you wait, since ROIC is very high.

Same logic applies here as with Toya. Those 3 million Ukrainians in Poland must create a lot of extra demand for what they are selling? While providing loads of cheap labour at the same time.

Now that I put it like that, I will probably buy some more on Monday!

As always, do your own work and I may sell at any time.

I did take a look a Toya recently and found it unconvincing. The business seems optically cheap but growth is very WC intensive. These WC tensions are now being financed with short term debt which has been piling up in the last few quarters which is a bit worrying given the high interest cost in Poland. I would say this is the reason why they recently suspended dividend payment. In summary, I dont like the FCF generation profile and BS is deteriorating rapidly (probably owning to a bad management on the finance front).