Start of a commodity supercycle?

Some bar charts

Generally higher commodity prices are the cure for high prices.

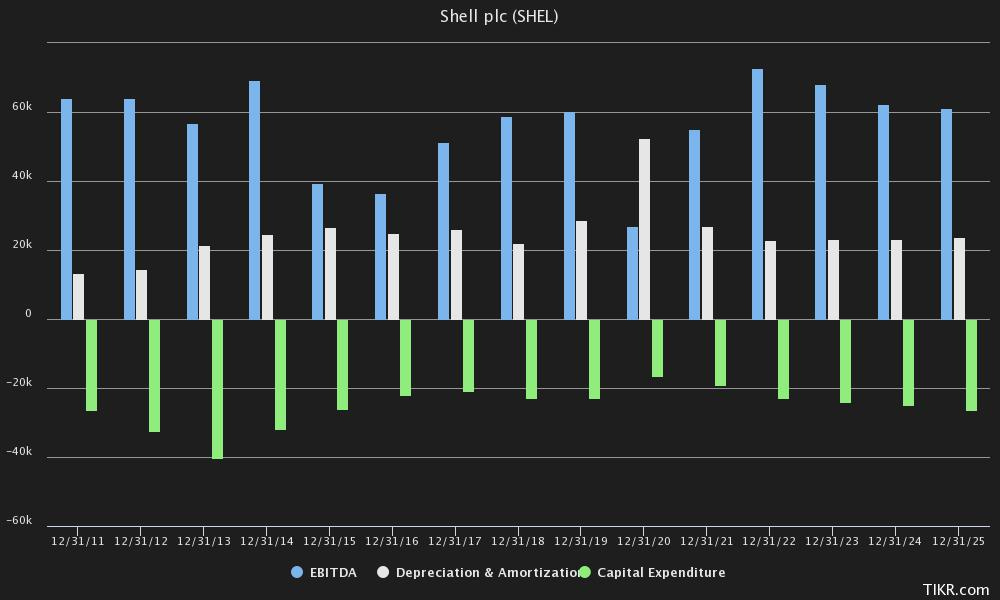

But look at the difference between capital expenditures and depreciation for some of the largest oil companies in the past and in the (likely) future.

Three of the leading US shale companies, of the handful or so with a 20+ year drilling inventory in the US (Pioneer did a lot of acquisitions):

Notice how ratio of capex to depreciation going forward is only barely >1x? And it used to be 3-4x in 2011-2014. These were the producers that caused the oil and gas price crash in 2014 and 2015. Also notice how they generated little to no free cash flow in 10 years?

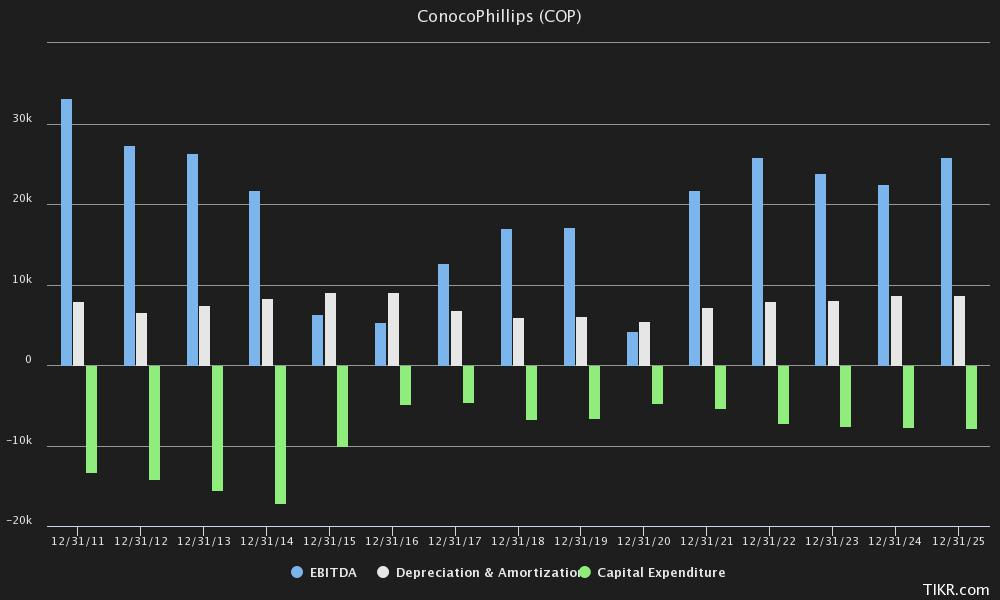

Similar with oil majors:

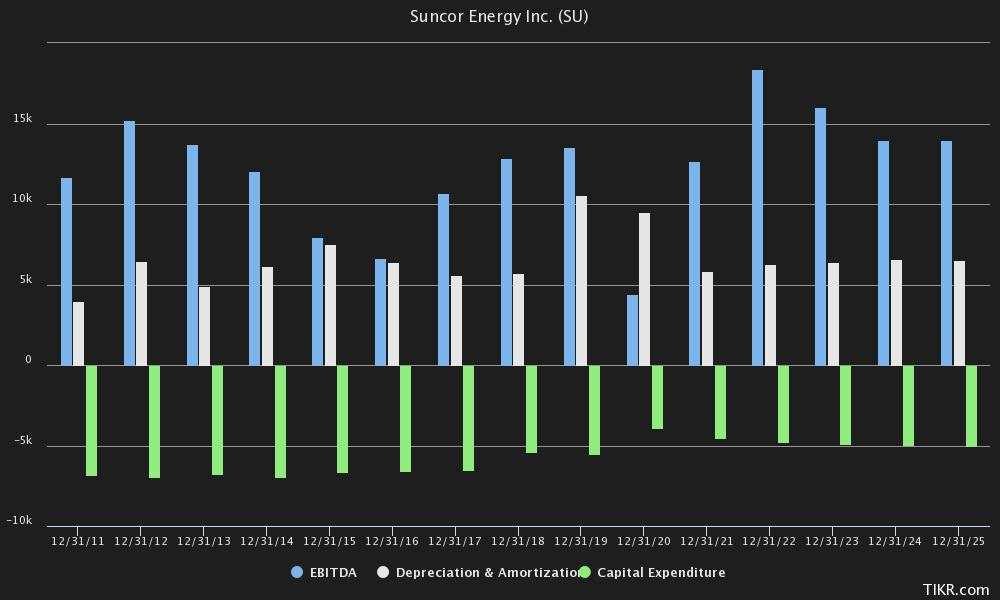

Canadian oil sands:

Trend seems to be far less growth capex going forward. Only one that has been somewhat stable is Suncor.

The trend is even more pronounced with US and Canadian gas producers.

And a bit less pronounced for major mining companies.

But I won’t post these since this post will become too large for email.

Overall the trend is higher EBITDA and significantly less growth capex relatively speaking.

And looking at the charts, most commodity stocks are only trading at or below their 10 year highs, and at half the price/tangible book value of 8-10 years ago. Even though FCF forecasts this time around are much much higher and capital discipline seems to be much greater.

So I think buying stocks that sell commodities or more commodified products in the right regions, that are trading at >10% FCF yields are going to be a good bet in the coming 5 or so years.

Because:

-More capital discipline because of sour shareholders that have seen little to no FCF in the past.

-ESG.

-Overly bleak outlooks because of two recent major commodity crashes.

-Consolidation.

-China shutting down lower value add industries like coal, steel, various chemicals due to pollution and shrinking work force.

-Sustained higher LNG prices.

Also think that a lot of unprofitable tech high flyers that still trade at high revenue multiples will have still further to fall.

Reason I wrote this post? To talk myself out of selling my commodity stocks too soon.