USD Partners

Rail terminals yielding a sustainable 20-25%?

USDP’s main Hardisty Terminal about to secure 33-100% of capacity with 10 year take or pay contracts, which is 22-68% of Q2 EBITDA

DRU process allows for safer and cheaper heavy oil transport by rail than pipelines

Trading near all time low valuation despite rosy outlook

3 year average FCF yield of 19% and LTM FCF yield of 25%

High return on tangible assets of >30%

USD Partners (USDP) caught my interest when I was searching for fallen dividend stocks last year. It lost over 70% of its value after cutting its dividend by a similar percentage. And was trading at about a 50% FCF yield at some point. At first it seemed this was because of weakening fundamentals, but after seeing insider buying and doing some digging I realized that fundamentals didn’t look all that bad.

USDP is a MLP that holds 3 rail terminals for loading, unloading and storing oil and 1 ethanol terminal which I will largely ignore in this write up. The Hardisty seems to be their main asset (source: presentation):

USDP’s terminals are essentially centrally located nodes to load oil between rail and truck/pipelines/storage.

Hardisty has a capacity for 150k bpd and is located in a major loading point for Canadian heavy oil towards the US. Casper has capacity for 105 bpd. And Stroud has capacity for 50k bpd and is located near Cushing, Texas. And West Colton for 13k bpd.

The Casper Terminal was purchased in 2015 for $225m and did $26m in EBITDA almost fully utilized. This acquisition turned out to be a total disaster so far since it did only a few million $ in EBITDA most recently (see page 47 of presentation).

From the same page 47 we can see that Hardisty generated 68% of adjusted EBITDA last quarter. So $44m of EBITDA annualized.

The Stroud terminal was acquired for only $25m in 2017 and expected to generate about $10 million in EBITDA. This is because at the time it was only at half capacity on a shorter term contract. The low purchase price was likely because not much was expected of this asset. Despite that, it generated aprox $14-15m of annualized EBITDA LTM (see page 47 of presentation) and is near capacity. So this at least appears to have been a good acquisition.

So if we add this all up there is probably room for nearly $90m of EBITDA. Subtract unit based compensation of $6m, $8m of capex (which I think is far too conservative) and $6m of interest, and normalized FCF could be in mid $60m range. On a current market of ~$190m.

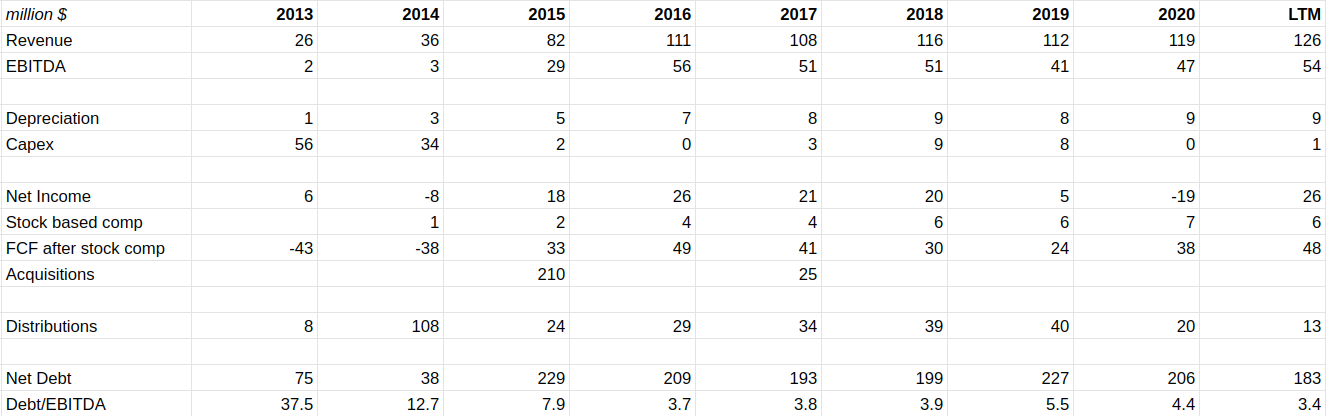

This is what actual FCF looked like in the past years, where I subtracted unit based comp from FCF as it is dilutive (click to enhance):

As can be seen here, a lot of capex was front loaded in 2013 and 2014, and likely maintenance capex is only a few million $ a year. So potential FCF at full capacity might be in the low $70m range. And a portion of maintenance capex goes through the income statement as well.

And please note there is a non economic $12.6m amortization charge of customer contracts. Which probably makes this stock screen rather poorly.

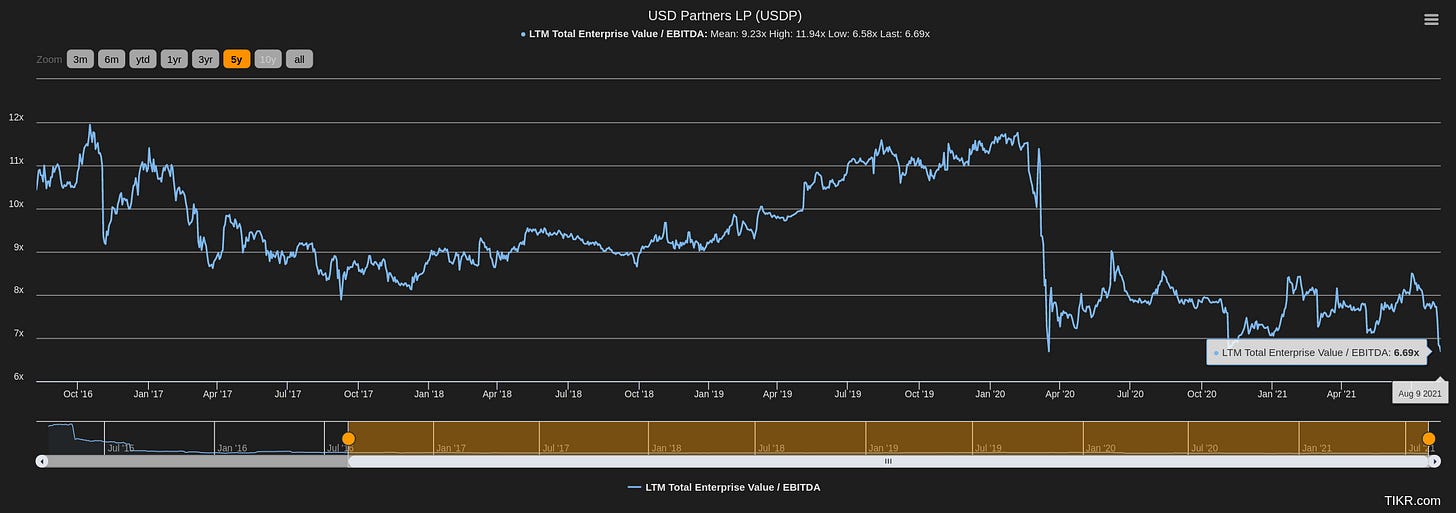

As for valuation, the company is trading around 5 year lows while having a all time low debt load and reaching 5 year highs in EBITDA:

Hardisty and DRU technology

What makes this especially interesting is that USDP’s Hardisty terminal will have capacity to move heavy oil by rail in a cheaper and safer way than by pipeline through USD group’s (USDG) and Gibson’s DRU technology. More info on how it works here and here. Important to note that USDP does not own this technology, but will benefit from it. The technology is owned in a joint venture by USDG and Gibson. USDG is USDP’s sponsor who owns aprox. 42% of USDP common units and owns IDR’s as well (more on that later).

In prior years USDP generally only signed 3-5 year contracts, but because of this new DRU technology, customers are now willing to sign 10 year take-or-pay contracts. About 1/3 of Hardisty’s capacity will be signed on in a 10 year take-or-pay contract with ConocoPhillips in August, and it is expected that the remaining 2/3 will sign similar contracts as well in the coming year. This will take away a lot of uncertainty about contract renewal and should mean the stock should trade at a higher multiple, given that more than 68% of EBITDA (in Q2 2021) will be pretty secure for some time to come.

Moreso it appears those contracts will be signed at a premium rate to current contracts (source: Q3 2020 call):

Unknown Analyst

Quick question. The -- as far as the DRU when it comes online, will you be getting a premium on any of the existing contracts with that service being available?

Dan Borgen

That's a great question, Gregg, and I appreciate that. Certainly, we will -- as we have calculated our commercial agreements with that, we will get some premium over our current present value -- related value of the Hardisty rail asset.

Management is optimistic that the remaining 2/3 of the Hardisty terminal, with current contracts ending June 2022, will be turned into 10 year take-or-pay contracts as well when remaining DRUbit capacity is finished. Which I am optimistic about as well as DRU makes it cheaper and safer to move rail by oil than by pipeline. So producers save money and increase their ESG rating all at once.

Even if that will not happen for whatever reason, it does appear demand will likely be high for Hardisty in the coming years (From Q2 10-Q):

Given these current market conditions as outlined above, our expectations are that WCS prices will reflect the need and incentivize egress by rail from Hardisty. The amount by which the West Texas Intermediate, or WTI, price of crude oil exceeds the WCS price of crude oil, referred to as the WCS to WTI spread, is a driver of activity at our Hardisty Terminal by providing the economic incentive to export barrels by rail. During the second quarter of 2021, the WCS to WTI spread was between $10 and $15 per barrel and was at the wider end of the range towards the end of the quarter. Future WCS to WTI spreads recently published by Bloomberg for 2022 through 2024 average approximately $14 per barrel and reach approximately $16.50 per barrel towards the end of 2024, which supports the economics required for a crude by rail egress solution.

The Casper terminal

USDP likely overpaid for this terminal judging by results so far. And this terminal does not appear to benefit from this new DRUbit technology. But there is some reason for optimism that capacity will be filled up again in the coming years. The terminal is located in a pretty central location and management strongly indicated there is interest here to move higher volumes and they sound optimistic. What helps as well will be the recently enhanced pipeline capacity of 50k bpd by Enbridge out of the Casper terminal.

The Stroud terminal

This terminal had contracts that were related to Hardisty, but with the new DRUbit 10 year contracts, most of these will be voided. Despite this the company seems to have new customers lined up and sounds very optimistic generally (Q2 2021 call):

Given these conditions, then our expectations are that demand for terminalling services and activity in all our assets will grow in late 3Q, 4Q. Specific to Stroud, which is unique because given the U.S. producers have been slower to respond to improved prices and production has not returned to pre-COVID type levels, Cushing continues to trade at a premium relative to the U.S. Gulf Coast and that's primarily driven by its continued inventory draws. Therefore, needless to say, this helps our commercial discussions going forward in negotiations with current customers and others to retain and/or attain control of capacity and access to Cushing are ongoing and very positive.

From the Q2 10-Q (emphasis is mine):

Additionally effective August 2021, the existing DRU customer has elected to reduce its volume commitments at the Stroud Terminal attributable to the Partnership by one-third of the current commitment through June 2022, at which point the agreement will terminate and there will be no renewal period. The existing DRU customer has also elected to fully terminate the volume commitments attributable to USDM at the Stroud Terminal. Management believes that the lower utilization at the Stroud Terminal as a result of successful completion of the DRU project will be short-term in nature

Incentives

So this is a MLP with incentive distribution rights (IDR’s). Most investors rightfully stay away from that. I have three counter arguments that might change their minds. The first is, this stock is incredibly cheap. Second, insiders own a significant stake of the common units with nearly 2 million units owned, and have been significant buyers:

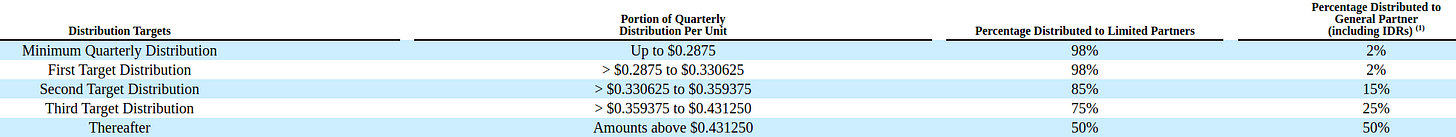

And third, USDG’s IDR’s only start to really kick in at distributions of about $1.44-1.72 per unit. And IDR’s should also motivate USDG to drop down further DRUbit terminals at a more attractive valuation if this would happen. So in this case I don’t think it is really a net negative. Since USDG owns 42% of the common units, this should actually motivate them to sustainably increase distributions again, which would be a significant catalyst for a rerating of the stock. In general I am not in favor of IDR’s though, but they can be nice in a unique situation like this.

Drop downs

So let’s address the elephant in the room here, why did they cut distribution? Arguably debt levels were quite reasonable and they pay <3% on it. I think the main reason for this is that USDG wants to drop down more DRUbit terminals into USDP. And fund that with debt. The risk here is obviously that this will happen at inflated multiples. I think this risk is greatly mitigated by USDG’s ownership of IDR’s. Until about $0.33 quarterly distributions per unit, USDP common unit holders are entitled to 98% of distributions. But above about $0.43 per quarter, USDG gets 50% (not of total, but of the amount above ~$0.43) through their IDR’s. Assuming USDP’s Casper terminal does not meaningfully recover soon, their asset base provides earning power for about $0.4-0.45 of distributions per unit per quarter. IDR table (page 114 of 2020 10-k):

So despite IDR’s being bad for minority holders most of the time, I think in this particular situation it isn’t so bad because it seems that returns on these terminals are quite high at a >30% ROA. Current tangible asset base of USDP is ~$150m while it generates nearly $90m of adjusted EBITDA LTM. So effectively minority holders would still get a 15%+ return if these terminals are dropped down at cost into USDP.

Say that Hardisty South is dropped down for $100m at cost (very rough estimate on my part), providing $30m+ of FCF, USDP minority holders would get $15m of that. And USDG would effectively get about $21.3m ($15m through their IDR and $6.3m through their 42% stake in common units). While cost of debt would likely be very low at 3-4% (currently <3%).

Now why wouldn’t USDG just drop it down for $300m, $200m above my hypothetical cost estimate? They would have an extra $200m in their pocket right now and still get roughly $10m in distributions, assuming a 5% interest rate. I think this risk is low, because they would only effectively take about 58% of this gain, plus the IDR’s would be a lot less valuable, since now at least $200m (not counting another $50-100m of interest) would have to go to debt payments instead of distributions (which they get 50% of, through their IDR’s). Additionally they would have to pay a capital gains tax on the $116m gain. So their effective gain would not increase. Their effective gain would only be (0.58 x $200m) - ($100m+ in lower IDR value) - (capital gains tax) = <0.

So yeah IDR’s are a bit screwy, but if you buy cheap enough, and there is an opportunity to drop down really attractive assets on long term contracts, they can actually still work in your favor. Given of course that insiders and the GP own a significant chunk of the same common units.

So to conclude, I think it is reasonably likely that somewhere in the next year or two, distributions will be increased again to $35-45+ million anually. If 2/3+ of EBITDA is secured with 10 year take-or-pay contracts, I don’t think this will be trading at a 20-25% dividend yield for long. Especially since FCF will be more secure than when this previously traded at $10-15, vs the current price of ~$6.8 per unit. So I am long at an average price of $4.44 per unit (I know I am late with this write up). And I may sell it at any time so DYOW.

Hi IJW

What do you make of the recent announcements and the disappointing dividend announcement?