At heart I am a value investor. But part of me is also a trader. I like to have a fundamental foundation that I can fall back on. But when I see a post like this on stocktwits by Stocksman45, the trader in me comes out:

Chinese stocks feel like loaded springs to me now. I have played this so far by buying DADA at $1.50 (I think I posted it at $1.67 ish) and closed it with a very nice profit at $2.6ish. I did buy RERE at $1.15 and sold my last shares at $1.85. Unfortunately I was too late to post a write-up as I got reporting dates confused :( . But maybe we get to have another go at this one. I had DQ on my watch list, I expected negative earnings, but their report was slightly better than expected and shares jumped from $18 to nearly $30 in a few weeks.

Basically the trade is, if the earnings report is vaguely good and/or they announce a capital return, the stock will likely jump. Because so much negativity is currently baked in. Of course you do actually have to pick stocks that are cheap and could have some kind of catalyst with evidence that more capital returns may be forthcoming (either because it was promised or the company has a history of returning capital).

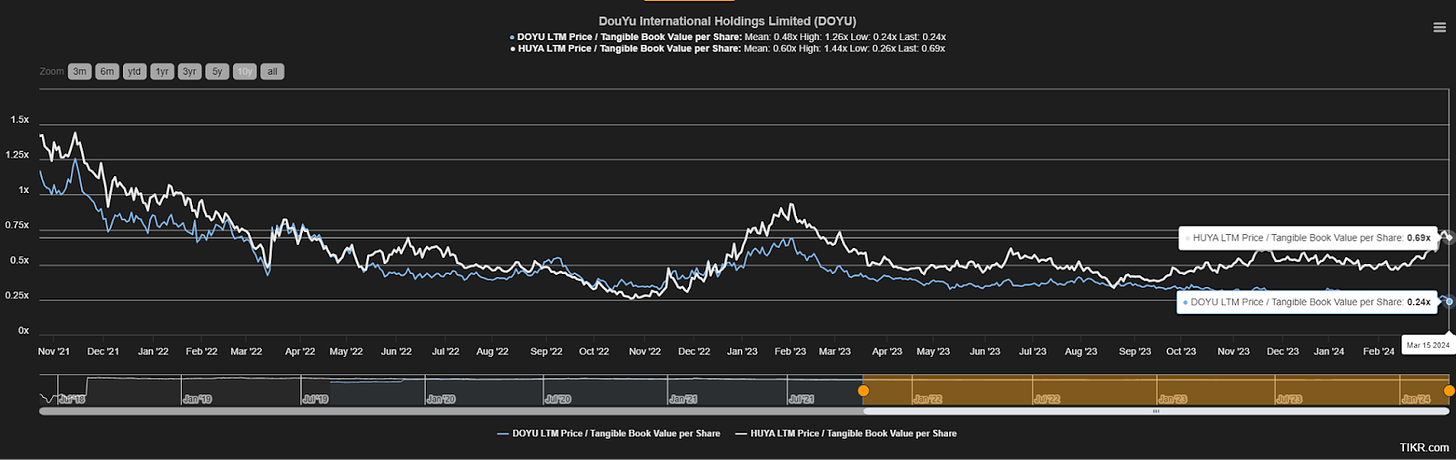

The first one I have bought is Douyu (DOYU), courtesy of JohnTill on Stocktwits. They are a Chinese version of Twitch with an almost worthless business and are trading at about a 75% discount to liquid net asset value (most of it cash). Tencent owns 38% of shares outstanding. Their near identical slightly larger competitor HUYA (Tencent owns 47% of this one) trades at only a 30% discount:

The spread has recently blown out. Now DOYU does have more dirt on it since the CEO Chen Shaojie did get arrested on charges of illegal gambling in November last year. But I consider this mostly inconsequential in the medium term since I value the business at 0 and the fine will likely be a rounding error compared to their net cash position + investments of nearly a billion $ (revenue was about $800 million in LTM). My main interest is in their cash pile and it is Tencent who is basically in the driving seat here anyway.

The company did recently announce a $20 million buyback with an expiry of 12 months, which caused the stock to jump to over $0.90/share but by the looks of it have not executed on it. Which probably caused it to sag back down to $0.7 currently. There were buybacks at much higher prices in the 2020-2022 period of about $100 million in total. So there is some precedent here. HUYA has also been buying back significant amounts recently (which is the likely cause of its recent share price performance). And has just announced a $0.67/share special dividend.

There was also a merger attempt a few years ago with HUYA, which was engineered by Tencent, but this was shot down by regulators.

Catalysts here are resolving the situation surrounding the CEO (likely with a small fine, and officially firing the CEO) and capital returns. And a remote possibility of another merger/buyout or a turnaround of the underlying business. If the stock merely trades at 35-40% of net cash, upside is about 40-60%. Although I will probably be out before that. I have traded this stock before and this is usually a nice entry point.

The second stock is Noah holdings (NOAH), first mentioned here at higher prices a few months ago. I feel a bit iffy about the stock, read here why I closed it again (the VIE structure is really the main sticking point), but the stock is now trading nearly 20% cheaper at 4-5x earnings with a commitment to return up to 50% of their adjusted earnings. If 2024 analyst estimates are correct that means up to $1.25/share will be returned in 2024 and $1.35 in 2025 vs a $10 share price now. The company has about $900 million in net cash and investments vs a market cap of $665 million. And is unlikely to be a fraud.

The bet here is that capital returns will be announced in their upcoming earnings report a week from now. And if earnings/outlook is even vaguely positive the market might respond quite positively. A mix between buybacks/dividends was mentioned on past calls, so I expect a buyback announcement. As a reminder, this is what Jingbo Wang, chairwoman and 22% shareholder said on their November 14 2023 investor day:

“As a shareholder, I hope 100% dividend of the profit that is my target, 100% dividend payout of the profit or maybe 50% and some buyback. More dividend, better buyback. So it's better to our shareholders. Our futures will be converted into stocks, whether that's approved by the Board or not, I don't know. But I will submit this report.”

There are also a lot of longer dated management and board stock options outstanding at significantly higher prices compared to the current share price.

These are not high conviction longer term holds, I basically opportunistically trade around them.

Then a possible third stock that I have mentioned before several times (first write-up here), is Greentree Hospitality (GHG). I expect a reinstatement of the dividend in their coming earnings release. They have paid regular sizable dividends in the past, have a large net cash position and earnings are growing. I estimate that the 2024 PE ratio is about 6x. Do note, this stock is quite illiquid with a very small float. So it is quite volatile.

Readers of this blog should do their own due diligence before buying or selling anything, since I have been wrong before and cannot guarantee all information in this write-up is 100% factual. I may buy or sell the above mentioned stocks at any time. I am not your financial advisor.

I am also watching NOAH for rather some time, but the main issue I see is potential clamp down on enablers of capital flight

Does anyone has any feeling about that (potential ) risk?

uf, so many things to comment/unpack here...

why do you deem that Stocktweet so extremely bullish?