Spanish Broadcasting

Possibly trading at 1x FCF

Multiple catalysts ahead to unlock value in form of improved results, relisting, refinancing at lower rate, rerating of the bonds

Potential for asset sales cover downside

Will probably not be tradeable for a while until the company uplists

Is trading at around 1-2x FW FCF by my estimate

Spanish Broadcasting (SBS), ticker SBSAA, has an excellent write-up by Junkbondinvestor already in March, but given recent developments I thought I would write a quick report as well. The quick summary here is basically that SBS went from $400m to $300m in net debt through negotiations with their Preferred stock holders earlier this year. Incurring only minimal dilution of just under 2 million shares. And results will likely improve significantly in coming quarters. Yet the stock is still only trading at ~$3 with just under 10 million shares out, fully diluted.

Results have so far been shown to be very good with a record setting Q2 (they post on their website only) being ahead of 2019. If they would just maintain their 2019 results, then free cash flow would likely be ~$15 million in 2022. But there are signs they could do significantly better than that. On their latest Q2 call management said that they had surpassed Q3 2019 radio revenue already just 2 months in the current quarter. I have never heard management of a company sound this upbeat and optimistic about the future on a conference call. In their closing remarks after questions were asked, the COO was even talking about how he was very excited and could not wait to share Q3 results. Well music to my ears as an investor!

So what could this mean for Q3 revenue? Radio revenue in Q3 2019 was $32m. Assuming $40m of radio revenue and 40% EBITDA margins (minimum guidance by management) would imply $16m of EBITDA per quarter. And that is not even counting their events which will run hot in 2022 with a lot of pent up demand!

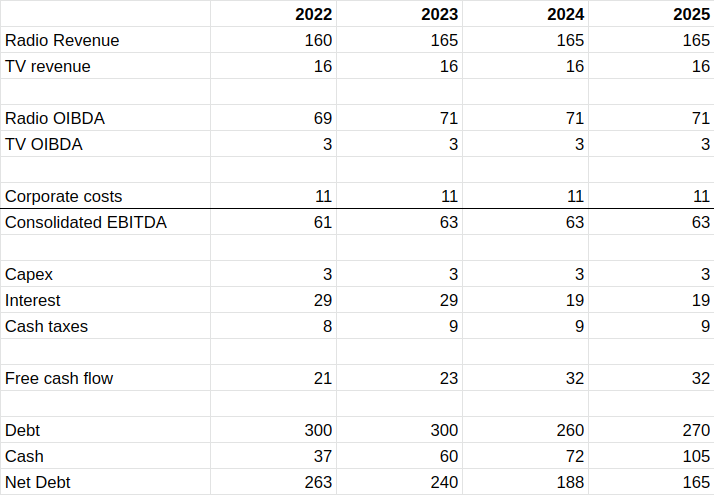

This is my base case going forward, assuming 41% EBITDA margins and a refinancing in early 2024 at an interest rate of 8%:

This would be my bull case, 43% EBITDA margins for radio and assuming they can keep up their good Q3 results and refinance at 7%:

Value the above 2023 and 2024 FCF assumptions at a modest 10x and it is not hard to see how you get a $15-32 stock price here a few years out. And how this stock could quickly delever to a very reasonable debt load within 4-5 years.

Interestingly it appears a lot of the revenue bump seems to come from a new deal they signed with Katz for their AIRE radio network. They have been talking about this for a while how it was underearning. And how signing on with Katz significantly improved their earnings (see Q1 call). And how it has a lot of operating leverage. So this means that 42% EBITDA margins could be conservative going forward.

Also their concert business could be a nice grower going forward, and their very popular LaMusica app is not really properly monetised yet either, which they expect to change as well. And despite being a radio company it does appear that their audience is growing. The way I see this is that they are essentially a very effective content (mostly music) curator. And provide a sense of community among Hispanics, with their concerts as well. It does not seem their audience is really aging either. So this does not appear to really be a dying business, yet it is priced like it is.

The BEAR case

What covers the downside is that they can probably sell their TV business and some real estate for $30-50m. Especially their TV business has a lot of potentially valuable spectrum attached as well. They sold a TV station in 2020 for $15 million and it barely impacted their TV revenue. Probably the reason they have not done this yet is that it is somewhat of a trophy asset for Alarcon and SBS expects to improve their Audio results significantly enough that it won’t be necessairy to sell their TV assets. Another possibility is that they expect 2022 to be a record setting political year, so maybe they will sell some TV assets in 2022 after posting good results?

Additionally, if they just muddle along the company could be put up for sale. It enjoys the highest ratings and margins in the industry, so it would probably not be that hard to sell it for more than $300-350m? I don’t think this will happen unless Alarcon’s hand is forced though.

Bear case seems to be mostly priced in now though. The stock was trading around $4 before 2017 when it was still listed on the NASDAQ and had $100m more debt and arguably worse prospects.

Urban One, a set of radio stations targeting a mostly black audience is trading at 8.7x EV/EBITDA, IHeart is trading at 7.2x 2022 EV/EBITDA, Townsquare media at 6.5x 2022 EV/EBITDA. And SBS only trades at about 6x EV/EBITDA! Despite having the best ratings, the highest margins and arguably the best growth prospects vs the other 3. Although the first two of these companies have significant NOLS, which SBS does no longer have.

Assuming an acquirer pays only 6x $60m of EBITDA for SBS’ radio business before corporate expenses, and their remaining assets would be sold for $40m, that would cover your downside rather well here.

Now why would they pay 9.5% for their debt? Significantly higher than Iheart and Urban One which have similar debt loads too. One possible reason was because of SBS Preferred stock situation, there was some time pressure to get a refinancing done. Additionally there are no covenants and Raul Alarcon does not want to incentivize debt holders to go for a liquidation scenario in a business downturn where they would take control of the company. Since this is his family company. If they perform well and refinance at a significantly lower rate, I think this could be a very solid catalyst in 2-3 years time though. So it hurts now, but could create a significant jump in FCF later.

Delisting

Because of Covid last year, management stopped reporting to the SEC to cut expenses. And because they only report on their website, they will likely be delisted in September due to new SEC rules relating to dark stocks. So if you are a holder, please call/e-mail the company to ask them to become Pink current, which only costs about $30k per year, and would keep the stock tradeable on at least the OTC exchange.

I am not too worried about this though, I do expect a relisting to the NASDAQ or NYSE within the coming year or two. So I am long at an average price of $1.77 per share (although it is lower in reality since I traded in and out of this stock earlier this year). And I may sell it at any time so DYOW.

6.2x EV/EBITDA on 2019 numbers, not too far off Townsquare Media's 7.0x. Fairly low numbers. But the bigger question: is radio a sector that you'll want to be invested in, longer-term?

I invested in some of these names in last downturn/recovery but the competition was tamer then (not as much podcasting). Do you think this is in terminal decline as revenues continue to decline? Do you think they will generate enough FCF to pay back debt or will they be dependent upon a favorable sale to generate positive returns for shareholders?