Westrock

A 15-20% FCF yield from cardboard boxes

I wrote an article about excess profits in commodities here. I thought I would follow up with a few more industries that I am actually invested in. But start with a very old industry that has not really seen a consolidation towards an oligopoly: the shipping industry.

As a refresher, here is the checklist of parameters to rate a commodity industry (although the network effect is missing from the list, not sure if I should add it):

Value to weight/volume ratio

Low cost advantage through geography

Economies of scale

Regulatory barriers of entry

Customer concentration

Cyclicality of demand

Ease of capacity exit

Time to bring on new supply

The shipping industry really has terrible economics. So I won’t waste much space on it and go through the list quickly.

Value to weight/volume ratio is not applicable here, shipping is a global industry.

Similarly there is no geographical advantage. Except for maybe some American shipping companies with the jones act? Doesn’t stop them from also lighting money on fire at the same rates as their non American peers though.

There are little economies of scale in shipping. Maersk’s shipping business seems to generate the same atrocious ROIC as its smaller peers. ROIC is barely cracking 5% over the past 2 decades.

Not much in the way of regulatory barriers of entry. Not much customer concentration.

Cyclicality is high and since there are no entry barriers it causes a lot of oversupply to flood in. Which will then stick around for 10-15+ years. So the ease of capacity exit is low.

And since time to bring on new supply is only a few years at most, the upcycles never really last long.

This is an industry with close to perfect competition. Good for the customer, bad for the investor. So best to just stay away, and move on to the more interesting paperboard industry.

Containerboard packaging

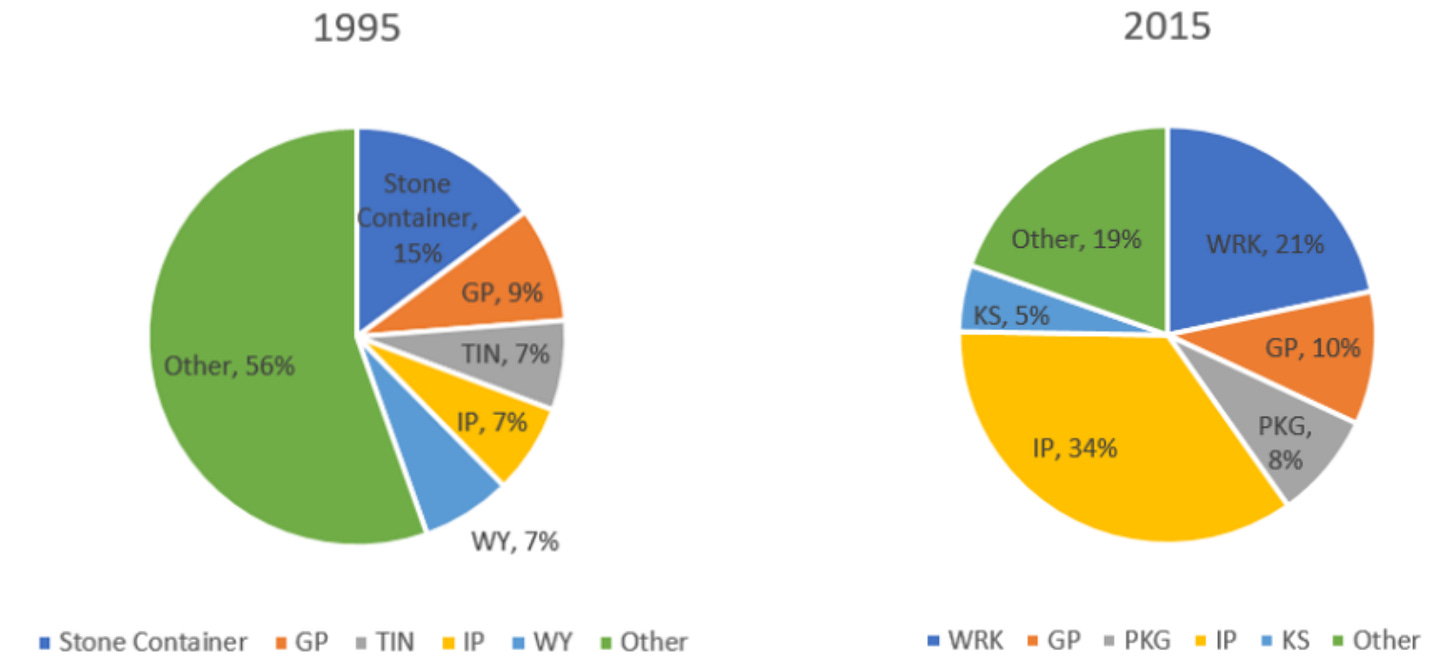

This industry has steadily consolidated over the past 20 years (source):

The star player is probably Packaging corp of America (PKG), with the highest ROIC (all on tangible assets only). Which has been trending up over the years as the industry consolidated:

It is a bit difficult to analyse, as there are different types of cardboard packaging with different requirements. And portions of it arguably can be considered value add. So it is not always 100% a commodity business. For example International paper is much less vertically integrated and generates a lower ROIC:

Furthermore the industry can be split up into mostly recyclers and mostly virgin fibre producers. A box can be recycled 5-8 times. Recyclers have higher energy and potentially material costs if there is a shortage of recycled fibre.

There has been a thesis floating around for a long time now that due to a shortage of containerboard (as limit of # of recycle turns is reached) price of containerboard will rise and virgin producers will benefit. But so far that hasn’t really played out. Recycling rates are steady at a low 90% range.

Building a new virgin fibre plant is not economical due to a combo of environmental regulations and production scale needed. And has not happened in decades (source):

Most virgin fibre production is located in the United States. PKG has the largest % of virgin fibre production at 82%.

Westrock

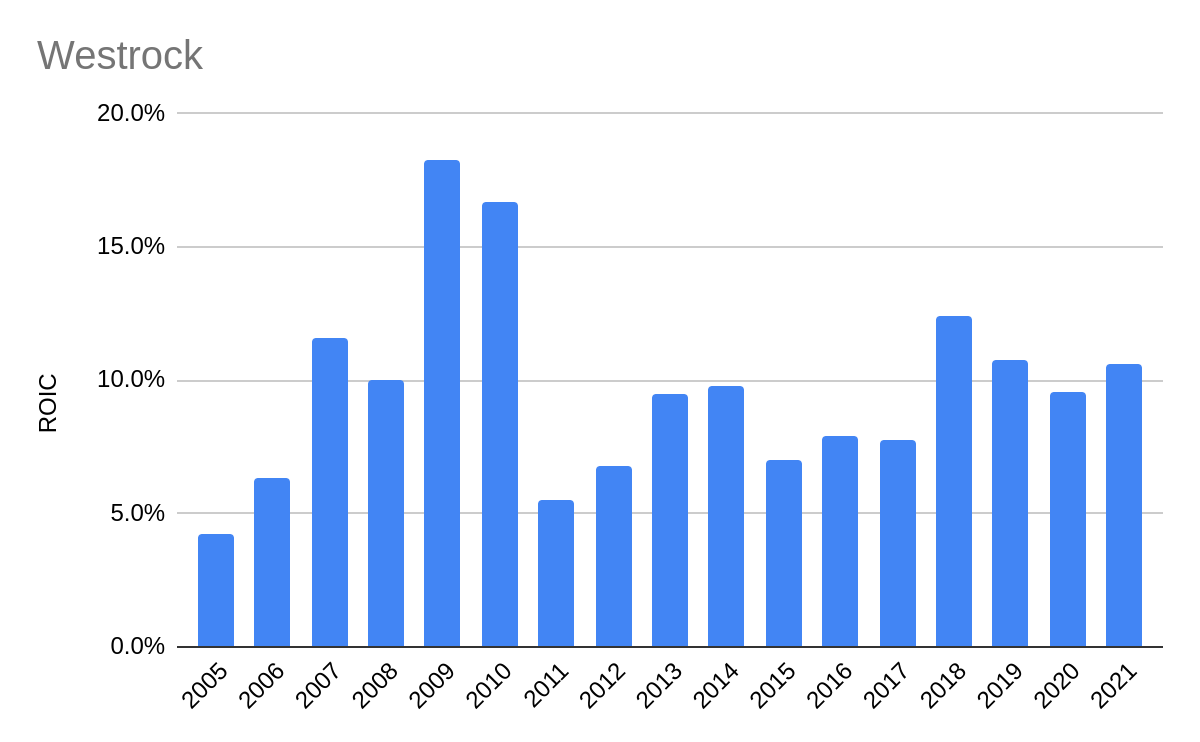

This is a stock I own in size. Virgin production is 65% of their volume. They have been gobbling up competitors and ROIC (not including intangibles) has not trended up much:

But since March 2021 they have a new CEO who has identified $1.5 billion in cost cuts and efficiencies to better integrate and modernise their recent acquisitions. Currently the market cap is just over $10 billion and adjusted earnings for 2022 will be ~$1.6 billion. This means earnings could go as high as $2.75bn if they hit all their targets. I think this is unlikely, and inflation will eat some of it away, but it shows how cheap the stock is.

Value to weight/volume ratio is quite low for corrugated products. The PKG annual report has this to say about it:

Corrugated producers generally sell within a 150-mile radius of their plants and compete with other corrugated producers in their local region. Competition in our corrugated products operations tends to be regional, although we also face competition from competitors with significant national account presence.

This means it is easier to get a larger concentration of the market. As a new plant would not be very competitive several states over. A new virgin fibre plant is estimated to cost about $1bn. So economies of scale are great. Furthermore, mass-procurement of raw materials gives larger players a significant advantage. Although Westrock is doing this suboptimally at the moment (part of that $1.5bn figure if they get this right).

And costs of a new virgin fibre plant are great because of regulatory barriers of entry. Environmental regulations make building a new plant prohibitively expensive. So this only really happens if limits of recycling are reached.

Customer concentration is low as WRK has 15,000 customers. And Cyclicality is low as well. Ease of capacity exit, I honestly don’t know. It will probably go up as the industry consolidates? For example Westrock has recently shut down an older unprofitable plant. Not all that relevant anyway with such low variability in demand.

Time to bring on new supply is low for recycled capacity at under 2 years, but high for virgin fibre capacity at 4-5 years.

So it is not hard to see how with increasing consolidation, ROIC is slowly approaching 20% if they hit at least some of that $1.5bn target. The closest cheapest (and inferior) competitor is IP, and it trades at 8.5x earnings, while WRK trades at just over 7x. Even though WRK has better earnings growth potential and a higher ROIC as a result. A more reasonable 10x multiple on say $2bn of FCF would make this a double.

So I am long Westrock at $42/share. I may sell at any time and ofcourse do your own DD.

nothing like a new ceo to come in and slash what more experienced predecessors deemed essential !

on a more serious note, the industry dynamics are good, but the specifics require a ceo with a track record in the domain, a history of a successful turnaround, and the right incentives (hunter harrison being the classic example)